We often have seen two letters code like EQ, BE, BL, BT, GC, IL, and IQ appearing just next to stock or any other financial instrument on the trading terminal of the National Stock Exchange (NSE). These are stock market abbreviations that every trader should know while trading in the stock market.

If you are a novice in the stock market, you might get confused with these abbreviations. These two-letter codes may look like Greek letters to you.

Don’t worry! in this blog, we will explain these codes which will make your trade quite similar when next time you place an order on the trading terminal of the National Stock Exchange (NSE).

What do these codes indicate?

India has two main exchanges – National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

NSE has recorded the highest volume traded compared to the other exchanges in India. In this exchange other than equities other financial instruments are also traded like Government securities, debentures, preference shares, close-ended mutual funds, etc.

As these instruments are traded in large volumes, the exchange has set certain categories for a stock under which we can trade.

These two-letter codes EQ, BE, BL, BT, GC, IL, and IQ indicate if we can invest in the particular stock or not.

So, if you are a trader who is already trading or looking to trade in the stocks that are listed on NSE, then you should familiarize yourself with these abbreviations used on NSE.

This will help you in getting a better understanding of trading in the stock market.

Stock Market Abbreviations:

Below is a list of the stock market abbreviations that you should know while trading in the stock market:

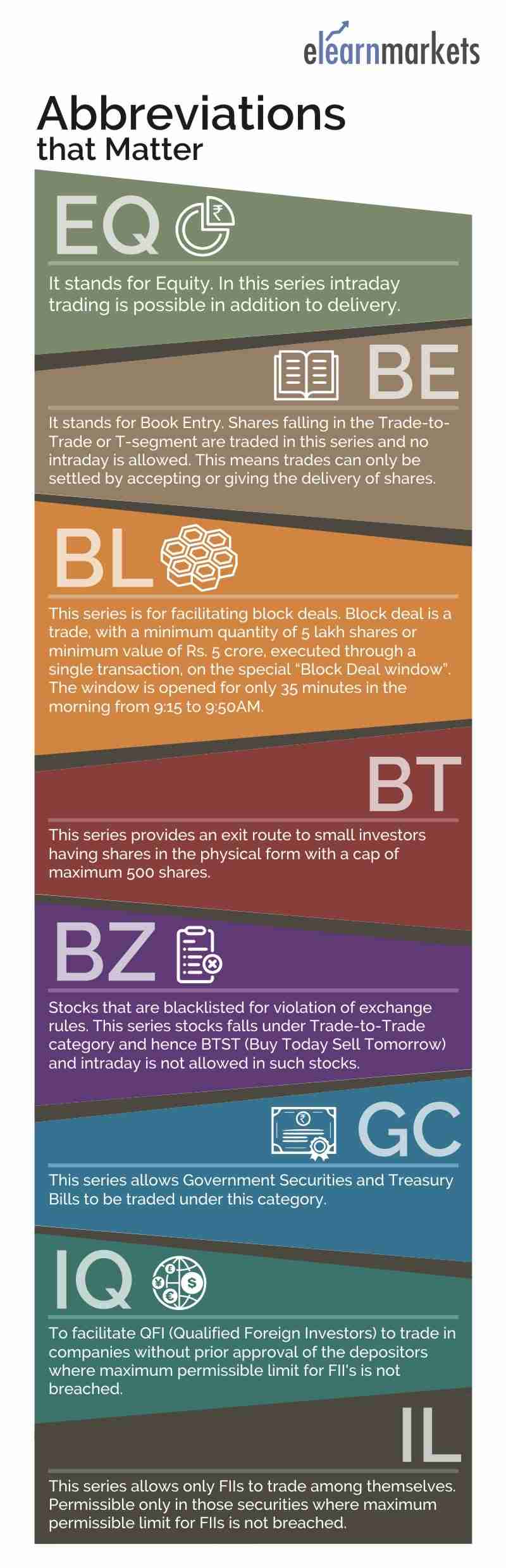

1. EQ

It stands for Equity. In this series intraday trading is possible in addition to delivery.

2. BE

It stands for Book Entry. Shares falling in the Trade-to-Trade or T-segment are traded in this series and no intraday is allowed. This means trades can only be settled by accepting or giving the delivery of shares.

3. BL

This series is for facilitating block deals. Block deal is a trade, with a minimum quantity of 5 lakh shares or minimum value of Rs. 5 crores, executed through a single transaction, on the special “Block Deal window”. The window is opened for only 35 minutes in the morning from 9:15 to 9:50 AM.

4. BT

This series provides an exit route to small investors having shares in the physical form with a cap of maximum 500 shares.

5. BZ

Stocks that are blacklisted for violation of exchange rules. This series stocks falls under the Trade-to-Trade category and hence BTST (Buy Today Sell Tomorrow) and intraday is not allowed in such stocks.

6. GC

This series allows Government Securities and Treasury Bills to be traded under this category.

7. IQ

To facilitate QFI (Qualified Foreign Investors) to trade in companies without prior approval of the depositors where the maximum permissible limit for FII’s is not breached.

8. IL

This series allows only FIIs to trade among themselves. Permissible only in those securities where the maximum permissible limit for FIIs is not breached.

Now that you know these abbreviations, you will be able to understand what does it means when you trade next time in the trading terminal of NSE.

Join our online course for stockmarket now!

Also, get stock market learning in hindi on our platform with our top mentors now!

To know more updates on the stocks, visit web.stockedge.com

Happy Learning!

Thank you Sir/ Ma’am, it’s amazing to learning stock market for beginners investors…

Hi,

We really appreciated that you liked our blog.

Keep Reading!