Today Gold is no longer used as currency but it can still be used as money. In fact, Gold has been a store of value for over 3000 years. Much longer than any currency anywhere.

In India, Gold is believed to be “God’s Money” and is offered to holy temples on almost all auspicious occasions. This makes India the largest importer of Gold in the world today and digital gold investment has become one of the best ways to invest.

Despite being in the midst of a global pandemic, Indians have found a new way to invest in the yellow metal – Digital Gold.

As people are hesitant to visit jewellery stores and gold dealers, being able to procure gold online has come as a perfect solution to many investors.

One Digital Gold investment, Augmont Gold Ltd. saw its businesses increase by 40-50% during the lockdown period.

So before we dive into what Digital Gold investment is, let’s do a quick rundown of how we have been investing in gold over the years:

Table of Contents

What are the Ways to invest in Gold?

Well historically the most common way to invest in Gold has been to buy physical gold in the form of :

- Coins

- Bullion and

- Jewellery.

Apart from that we have Sovereign Gold Bonds, Gold Mutual Funds and Gold ETFs to choose from.

But during a pandemic, another method of investing in Gold that has been gaining immense popularity is in the form of Digital Gold Investment.

What is Digital Gold?

Buying physical gold certainly has its downsides. There are issues of identifying its legitimacy and purity, then there are problems of safekeeping and storage. One more issue is that we are in the midst of a pandemic. It is not quite ideal to go out to gold dealers or jewelry stores.

Digital gold investment, on the other hand, can be bought online and is stored in insured vaults by the seller on behalf of the customer. It also helps us overcome all the aforementioned issues of physical gold purchases. All you require is Internet/mobile banking and you can invest in gold digitally anytime, anywhere.

How Digital Gold works?

You can do digital gold investment from several mobile e-wallets such as Paytm, Google Pay, and PhonePe. Brokers such as HDFC Securities and Motilal Oswal also have an option for digital gold investing.

Currently there are three companies that offer digital gold investment options in India-

- Augmont Gold Ltd.

- MMTC-PAMP India Pvt. Ltd. a joint venture between state-run MMTC Ltd. and Swiss firm MKS PAMP.

- Digital Gold India Pvt/ Ltd with its SafeGold brand.

Apps and websites like Paytm, G-Pay, etc only provide a platform for metal trading companies SafeGold and MMTC PAMP. Once you invest in digital gold, these trading companies purchase an equivalent amount of physical gold and store it under your name in secured vaults.

But is the process actually as easy and convenient as it sounds?

Let’s take a look at how you can invest in Digital Gold

How to trade in Digital Gold?

First, you visit any of the platforms which offer digital gold investment such as Groww, Paytm, HDFC Securities, G-Pay, Motilal Oswal etc.

Once you are on their platform, you perform the following steps:

- Enter an amount in ₹ or grams – You can buy gold of a fixed worth, or buy by weight at the live market rate.

- Choose your payment method – Once you complete the KYC process, you will have multiple payment options to choose from such as an account, card, or wallet.

- Store your gold in a secured locker – Your account is updated instantly, and can be accessed 24/7.

- Sell whenever you want – You can choose to sell your gold digitally itself to the platform whenever you want.

- Take physical delivery of the gold – In case you chose to not sell the gold, you can request for doorstep delivery of your gold in the form of coins or bullion. Note: Delivery fees are applicable.

Benefits of Investing in Digital Gold

- You can take physical delivery of the gold at your doorstep.

- You can invest an amount as low as Re.1.

- Digital Gold investment can be used as collateral for online loans.

- Digital Gold investment is genuine and the purity is 24K 99.5% for SafeGold and 999.9 in case of MMTC PAMP purchases.

- Your purchase is stored safely and is also 100% insured.

- You can exchange digital gold for physical jewellery or gold coins and bullion.

Disadvantages of Digital Gold Investment

- Limit of Rs.2 lakhs for investment on most platforms.

- Lack of an official government-run regulating body such as RBI or SEBI.

- Delivery and making charges are further applied to the price of gold.

- In some cases, companies only offer a limited storage period, after which you either have to take physical delivery or sell the gold.

Why Gold is shining during a pandemic?

| Price on 1st Jan 2020 | Price as of 28th Oct 2020 | Returns % |

| Rs.39,100 | Rs.52,300 | 33% |

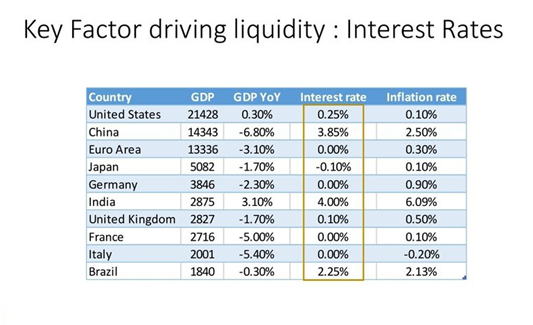

Gold acts as a safety net during times of crisis. Let us take the recent Covid19 crisis as an example to corroborate the former statement.

A nationwide lockdown meant furloughs and increased debt burden for consumers and businesses alike. To keep the economy growing, the government and the Reserve Bank of India had to increase spending while limiting growing debt levels.

Such measures came by way of a Fiscal Stimulus and Atma Nirbhar Bharat packages.

This essentially meant more money supply which put more cash in the hands of the people of India. This oversupply reduces the purchasing power of the currency and fears of rising inflation grows rampant.

But Gold as an asset class preserves the purchasing power against falling currencies. As a result, the demand for Gold increases and hence with that comes an increase in Gold prices.

This vicious cycle of increased debt burdens leading to a need for stimulus packages always results in a weakening purchasing power of the currency or inflation. So during uncertain times, Gold truly shines!

Conclusion

There is little doubt that Gold as an investing class should make up a small part of our portfolios. But there are better options to invest in gold such as Sovereign Gold Bonds and Gold ETFs rather than going for Digital gold investment.

The key reason being that gold should be a part of a long term portfolio. In that sense, it is better to go with gold bonds as they pay an additional 2.5% interest. But since bonds are less liquid, for short term hedges, investing in Gold ETFs is a better option as they fall under the regulatory body of SEBI.

Once the investment limit of Rs.2 Lakhs and a regulatory body is appointed, Digital Gold would make for an appealing investment for those who prefer investing in physical gold.

Frequently Asked Questions

Is it safe to invest in digital gold?

Digital gold may look like a good option for those who want to buy physical gold for consumption, as they don’t have to worry about the storage.

Is it profitable to purchase digital gold?

You can do digital gold investment from several mobile e-wallets such as Paytm, Google Pay, and PhonePe. Brokers such as HDFC Securities and Motilal Oswal also have an option for digital gold investing.

Which is better? Digital gold or gold fund?

Digital gold is linked to the live commodity price whereas Gold bonds, ETFs and Gold funds only give you the exposure to the commodity’s market performance.

Which gold scheme is best?

if you want to invest in gold then Sovereign gold bonds are decent investment . You get capital appreciation for gold +2.5% annual interest which is much better than holding physical gold where you have to locker fees.

Thanks for the post!

Hi,

We are glad that you liked our blog post.

Thank you for Reading!