Disclaimer: This is not tax advice. Readers are advised to consult a tax professional for advice specific to their portfolio.

Capital gains tax is a levy on the profit made from the sale of an asset, such as stocks, real estate, or other assets.

A profit that results from an individual or organization selling an asset for more than the cost of purchase is referred to as a capital gain.

After that, the gain is subject to taxation, the exact amount of which is decided by a number of variables such as the asset’s kind, the length of the holding period, and the taxpayer’s total income.

Short-term capital gains tax and long-term capital gains tax are the two main categories of capital gains taxes.

In today’s blog, let us discuss about short-term capital gains and how it is calculated-

Table of Contents

What are Short-Term Capital Gains?

Profits from the sale of assets held for a short time—usually less than a year—are referred to as short-term capital gains. Stocks, bonds, real estate, and other investments can all be considered among these assets.

The difference between the asset’s sale price and its purchase price is used to compute the gain. Short-term capital gains are taxed at a different rate than long-term capital gains, which are obtained from the sale of assets held for more than a year.

The asset’s holding period determines whether gains are classified as short-term. Any profit that results from selling an asset within a year of purchasing it is seen as a short-term capital gain for the investor.

The day following the purchase date and the day of the sale are used to calculate the holding period. If the investor keeps the asset for more than a year, the gain is categorized as a long-term capital gain.

Let us understand this with an example-

Let’s say an investor pays Rs. 50 per share for 100 shares of a company’s stock on January 1st.

The investor chooses to sell the shares for Rs. 70 a share on July 1st of that same year.

The purchase price is deducted from the selling price to determine the short-term capital gain, which is Rs. (70 – 50) * 100 = Rs. 2,000.

Given the shorter holding period of one year, the Rs. 2,000 gain qualifies as a short-term capital gain.

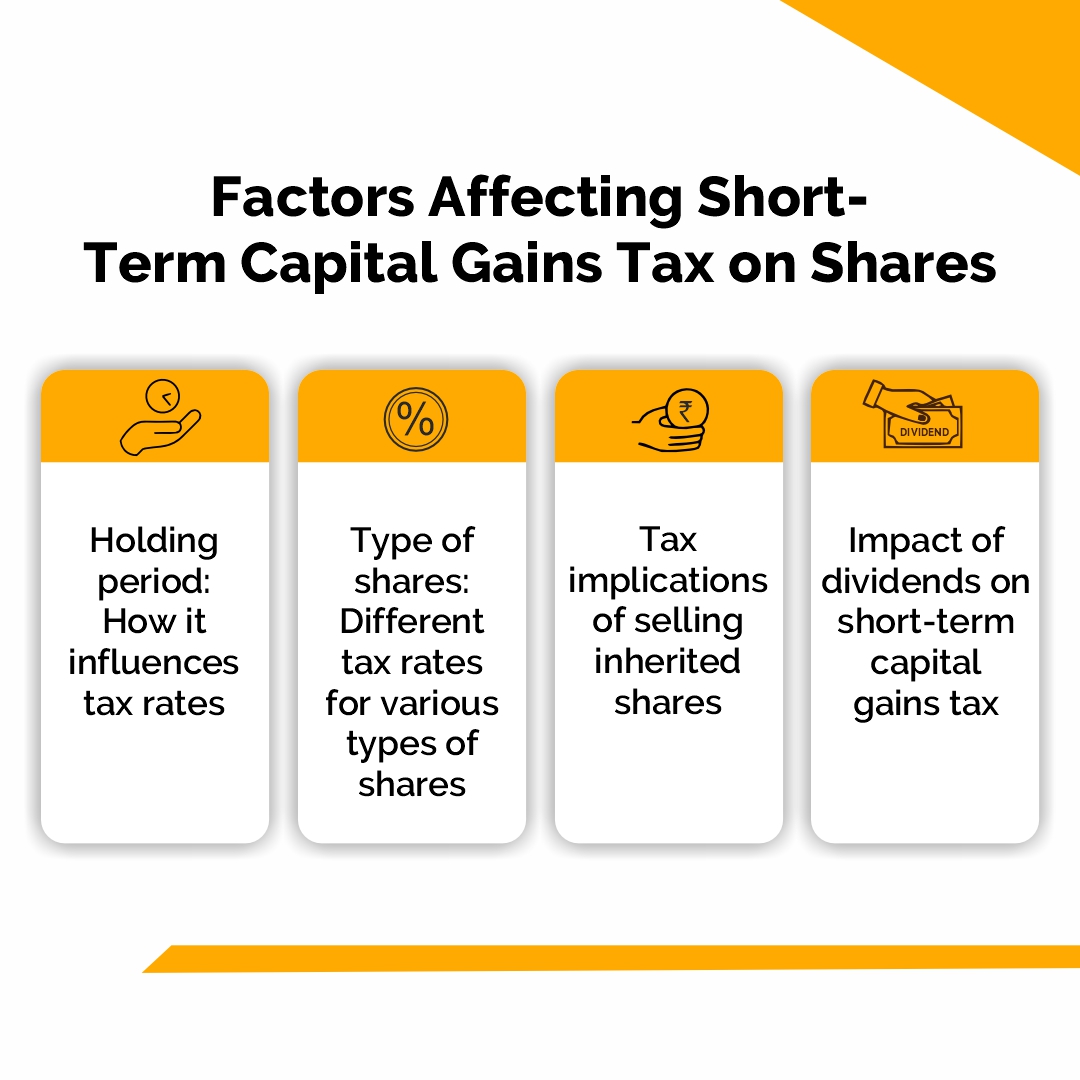

What are the Factors Affecting Short-Term Capital Gains Tax on Shares?

Here are some Factors Affecting Short-Term Capital Gains Tax on Shares:

Holding period: How it influences tax rates

One important aspect affecting the short-term capital gains tax rates on shares is the holding time. A capital gain is classified as either short-term or long-term under the tax code, depending on how long an investor keeps an item before selling it. The tax treatment is more beneficial the longer the holding period:

Holding for a shorter period of time than a year: Short-term capital gains are subject to ordinary income tax rates, which might differ considerably from the taxes on long-term profits. This is intended to deter speculative trading that is done in the short term.

Long-Term Holding (More Than a Year): Gains on shares held for more than a year are regarded as long-term and are therefore liable to lower capital gains tax rates. These rates are usually more favorable, which encourages investors to take a long-term strategy to invest.

Type of shares: Different tax rates for various types of shares

The short-term capital gains tax rates might also be influenced by the kind of shares that an investor owns. Certain investment kinds might be subject to particular tax laws, and tax rates might change depending on a number of variables, including the investment’s nature and the investor’s income level.

Common Shares: The majority of common shares are subject to the regular capital gains tax regulations. These shares’ short-term gains are subject to regular income tax rates for the individual.

Qualifying Small Business Stock: Gains on qualifying small business stock may occasionally be subject to favorable tax treatment for investors. The tax code may encourage support for small enterprises by offering exemptions or lower rates for qualified investments.

Tax Implications Of Selling Inherited Shares

Inherited shares may be subject to different tax rules than shares purchased directly, and gains may be treated differently.

The cost basis of shares that are inherited by a person is typically “stepped up” to reflect the fair market value of the shares at the time of the original owner’s passing.

Since the taxable gain is determined using the stepped-up basis, selling the shares soon after inheritance may result in lower capital gains taxes.

Impact of Dividends On Short-Term Capital Gains Tax

Shareholder dividends have the potential to impact one’s entire tax situation, particularly in the case of short-term capital gains. Since dividends are usually taxed at particular rates, a taxpayer’s tax bracket may change if their total income includes dividends.

Regular Dividends: An investor’s regular income tax rates apply if they receive ordinary dividends from their shares. When paired with other sources of income, this may raise the overall tax obligation on short-term capital gains.

Dividends that meet certain requirements may be eligible for special tax treatment as “qualified dividends,” which could result in reduced tax rates. The total tax obligation related to short-term capital gains may benefit from this.

Calculation of Short-Term Capital Gains Tax

Let us discuss how Short-Term Capital Gains Tax is calculated:

1. Determining the Sale Price Of Shares

The sum at which an investor sells their shares is known as the sale price of shares. This is an important part of the short-term capital gains tax calculation. It is the entire amount of money made from the sale, including all additional fees or transaction charges related to the sale.

The sale price is calculated as follows: sale price = number of shares sold × selling price per share − transaction costs

2. Calculating the Cost Basis

The cost basis represents the entire amount spent on purchasing the shares, including the purchase price and any related transaction fees. It is crucial in determining whether there would be a capital gain or loss on the sale of the shares.

The cost basis formula is:

Cost Basis = Purchase Price per share + Transaction costs × Number of shares acquired

Adjustments might be required to ascertain the correct cost basis if the shares were obtained through gifts, inheritance, or stock splits.

3. Understanding Net Capital Gains

The cost basis is deducted from the sale price to determine the net capital gains. This is an accurate representation of the gain or loss realized from the share sale.

The Net Capital Gains formula is as follows: Net Capital Gains = Sale Price − Cost Basis

Cost Basis − Sale Price equals Net Capital Gains

A positive outcome denotes a capital gain, whereas a negative outcome denotes a capital loss.

4. Applying the Applicable Tax Rate

Applying the appropriate tax rate comes next after determining the net capital gains. The individual’s regular income tax rates apply to short-term capital gains. The income level and filing status of the taxpayer can affect these rates.

The Short-Term Capital Gains Tax formula is as follows: Short-Term Capital Gains Tax = Net Capital Gains × Ordinary Income Tax Rate

Net capital gains × Ordinary income tax rate equals short-term capital gains tax.

Section 111A-covered STCG is subject to a 15% tax (plus any relevant surcharge and cess).

Normal STCG, or STCG not covered by section 111A, is subject to taxation at the regular rate, which is established based on the taxpayer’s total taxable income.

As an example: The STCG tax rate covered by section 111A

After owning the equity shares of SBI Ltd. for eight months, Mr. Kumar sold them through the Bombay Stock Exchange. What tax rate will be in effect for the STCG?

Since section 111A applies in this instance, the STCG will be subject to a 15% tax (plus any applicable surcharge and cess).

Adjustment of STCG against the Basic Exemption Limit

The basic exemption limit is the maximum income below which an individual is exempt from paying any taxes. The following is the basic exemption limit that applies to an individual for the fiscal year 2023–2024:

• The exemption limit for residents who are 80 years of age or more is Rs. 5,000,000.

• The exemption limit is Rs. 3,00,000 for residents who are 60 years of age or older but under 80.

• The exemption limit for residents under 60 years of age is Rs. 2,50,000.

• The exemption limit for non-resident individuals is Rs. 2,50,000, regardless of the individual’s age. [As modified by the 2023 Finance Act]

Example-

Mr. Kapoor, a 25-year-old resident, is a salaried employee who receives an annual taxable salary of Rs. 1,84,000. In addition to his pay, he has received Rs. 6,000 in interest from a fixed deposit. He doesn’t make any additional money. What is his projected tax obligation for 2023–2024?

The basic exemption limit for residents under 60 years of age is Rs. 2,50,000. Since Mr Kapoor’s taxable income in this instance is less than the basic exemption amount of Rs. 2,50,000 (Rs. 1,84,000 + Rs. 6,000), he will not be required to pay any taxes.

Learn Proven Strategies to Legally Reduce Your Capital Gains Burden with Our Stock Market Courses

Conclusion

It’s crucial to remember that the tax rate on short-term capital gains is frequently greater than the tax rate on long-term capital gains. To determine their exact tax due, taxpayers should review the most recent tax rates and brackets.

Investors must comprehend and compute these elements precisely in order to evaluate the financial effects of their choices and efficiently plan their tax strategies. It is best to speak with a tax expert for tailored guidance based on unique situations.

Frequently Asked Questions (FAQs)

What is short-term capital gains tax on shares?

The profit made from the sale of shares or other securities that have been held for less than a year is subject to short-term capital gains tax. Short-term capital gains are usually subject to higher tax rates than long-term capital gains.

What factors influence short-term capital gains tax rates?

Short-term capital gains tax rates can be impacted by a number of variables, such as dividends, the holding duration, the kind of shares, and the tax consequences of selling inherited shares. Comprehending these variables is vital for precise tax preparation

Visit StockEdge for more Market Updates