As a citizen of India, we all are aware of taxes that we need to pay to the Government (as Income Tax) at the end of every fiscal year.

Along with that, on a daily basis, we pay a lot of taxes in the form of GST(Goods and Services Tax) or Indirect Taxes.

GST is charged on various goods and services that we buy or take.

Similarly, a company also needs to pay taxes to the Government on the income that it has generated throughout the year in the form of Corporate taxes.

So, in this blog, we will decode the different taxes in the financial statements of a company.

What do we mean by Corporate Tax?

Corporate Tax is an expense which is charged on the Net Profit which a company earns from its business in India.

It is taxed at a specified rate as per the tax bracket prescribed by the Income Tax Act, which is subject to change with Income Tax changes.

Suggested Read: Choosing Correct Form For Tax Return Filing

Tax as an expense can be found in the Profit & Loss Statement of a company.

A few years ago, some companies used to avoid taxes by giving huge dividends.

They were profitable companies but did not pay taxes or they reported nil or negative income under the provisions of the Companies Act.

This was because the Income Tax Act used to provide a lot of deductions, exemptions and other incentives in the form of liberal rates of depreciation which helped the companies to evade taxes.

Suggested Read: Tax cut a – BOON

Thus, Minimum Alternate Taxes (MAT) was introduced under Section 115 JA of Income Tax Act, where all companies that record a book profit shall have to pay a minimum alternate tax @18.5% (plus surcharge and cess as applicable) under the Companies Act.

Now lets study the tax structure in an Income Statement in detail:

Types of Tax Expenses in the Financials of a Company:

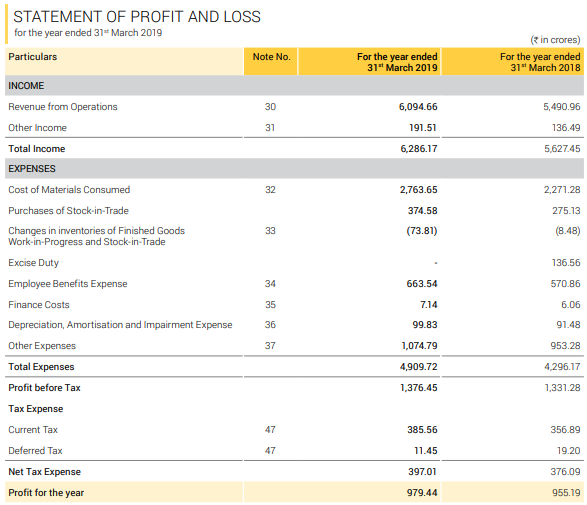

From the above financial statement, we can broadly bifurcate ‘Tax Expense’ as:

Current Tax:

This is basically the tax which is currently payable on the taxable profits for the year.

These profits are reported under ‘Profits before Taxes’ just above the head ‘Tax’. Any Company’s current tax is calculated using the current applicable corporate tax rate which has been enacted by the Income Tax Act.

Deferred Tax:

Deferred tax is that part of the tax which is due for the current period but has not been paid yet.

The deferral comes from the difference in timing between the tax accrued and the tax paid.

The deferred tax liability represents a future tax payment or obligation a company is expected to make to the Income Tax authorities in the future.

In every Income statement, there would be a ‘Note No.’ written in front of most of the heads.

These depict that further calculations are shown in the ‘Notes to Accounts’ section of a Financial statement.

When we go into the Tax part in the ‘Note to Accounts’, we will see further diversification under ‘Deferred tax’.

These are named as:

- Deferred Tax Assets

- Deferred Tax Liability

What are Deferred Tax Assets?

Deferred Tax Assets arise when a company has overpaid its taxes to the Government or has paid some part of the taxes in advance.

It can be conceptually compared to rent which has been paid in advance.

These taxes are returned back to the business in the form of tax relief, and thus the over-payment is, therefore an asset for the company.

Deferred taxes are created when the company recognizes the revenue or expenses at different times than that of the accounting standards period.

These tax assets help in reducing the company’s future tax liability and also increasing the future profits after taxes.

What are Deferred Tax Liabilities?

Deferred Tax Liability (DTL) is the tax liability that has been assessed and is due for the current year and has not yet been paid.

The DTL depicts that the company has to pay more tax because of a transaction that has taken place during the current period.

In a simpler way, we can define DTL as the amount of taxes that a company has underpaid and has to be paid in the future.

Here, underpaid does not necessarily mean that it has not fulfilled its tax obligations, rather it is recognizing the tax obligation on a different time-table.

Deferred tax liabilities generally tend to reduce the profits after taxes as the tax amount increases in the Profit & Loss statements.

How do taxes affect a company’s profitability?

Profits before taxes (PBT) are the net earnings that a company earns after paying all the cash and non-cash along with operating and non-operating expenses.

But, a company also needs to pay off to the government a part of its earning as corporate taxes.

Corporate tax rates affect the company’s tax liabilities. It also changes the deferred tax assets as well as the liabilities of a company.

If the tax rate increases, deferred taxes (deferred tax assets and liabilities) will also increase and vice versa. A decrease in the tax rate decreases the deferred tax liabilities, which reduces future tax liabilities for the company.

On the other hand, a decrease in the deferred tax assets reduces the value towards the offset of future tax payments.

The report reveals that around 12 percent of the corporate frauds are related to the evasion of taxes in the listed as well as the unlisted space.

This depicts that the Corporates try out various ways and means to evade taxes by implementing various accounting gimmicks.

Reliance, under Dhirubhai Ambani’s governance, used Depreciation and other means as a tool to lower its taxes and inflate the profits of the company till 1996. Only after this, the MAT (Minimum Alternate Tax) was introduced.

Key Takeaways:

Thus, taxes do form an important part in a financial statement. Recently, India’s FM Nirmala Sitharaman lowered the corporate tax rate to 22% from 30% for existing companies and 15% from 25% for new manufacturing companies subject to other conditions being met.

This was a big move on the part of the government which was used to increase the profitability of the various companies.

Lower taxes meant higher profitability and higher FCFF which can be used by the companies to ramp up Capex activities and investments so that the earnings start inching up at the time when the overall economy was going through a prolonged slowdown thus indirectly aiding tax collections. As higher bottomline would create room for more taxes in future for the government.

As investors we must take a brief look at the notes to accounts as a part of the financial statement in order to understand the tax obligations of a company. Though, for a layman, it is not possible to understand the complete accounting treatment of the taxes, but a brief overview of the company’s tax obligation will help us understand the company’s tax structure.

To learn about how to analyze the financial statements of a company, you can take our top-selling course on Equity Research Analysis:

To do this course online, you can click here: Certification in Online Equity Research Analysis

For the offline course, you can click here: Certification in Equity Research Analysis