A personal loan is one of the most convenient ways to borrow a small or large pool of funds from banks when you need them. Be it a medical emergency or a payment towards a big expense, a personal loan can come in handy as the need arises for a variety of costs.

Anyone who’s over the age of 18 can avail of the benefit of a personal loan. However, this isn’t free of charge. Without any collateral, banks often charge higher interest rates to balance the risk they take by giving you the loan.

Let’s understand simple ways to get the best personal loan rates in India. This will not only help you borrow wisely but also save money.

What are personal loan interest rates?

Personal loan interest rates are the costs you incur when borrowing money from a bank or lender.

Let’s understand with an example.

If you borrow ₹1,00,000 from a bank at a 12% interest rate, you will pay 12% of that amount as interest each year. This means you’ll pay ₹ 12,000 in interest for the first year. In the subsequent years, you will keep paying 12% of the balance amount of the loan remaining outstanding (unpaid) in that year.

What does the rate of interest depend on?

It is interesting to note that the interest rates on personal loans will not be the same for everyone. These loans are provided by the banks without asking for collateral like property or other assets. So, lenders generally ask for higher interest rates than collateral-backed loans, such as home loans or car loans.

The rule of thumb is that if the lender feels that the chance that you may default (i.e. not repay the loan, then it will charge a higher interest rate from you, and vice versa.

The interest rate that you will get will depend on a few things like:

- Current income: If you have a steady income, the bank might trust you more and offer you a better rate.

- Your credit score: If you have a good credit score (i.e. CIBIL score), you might get a lower interest rate. We will discuss this in the next section.

- Past track record: If you have defaulted on any loan in the past, then you will end up paying a higher interest rate since the bank will assume that it is taking up a higher risk by giving the loan to you. On the other hand, if you have a great track record of repaying past loans, the bank will feel more comfortable in giving you the loan at a lower interest rate.

- Tenure of the loan: Personal loans taken for a longer tenure tend to attract higher interest rates, as there is a higher chance that the borrower may default within this longer period of repayment.

- Current debt-repayment burden: If you are currently paying the EMIs for other loans every month, then the risk that you may fail to repay the EMIs for the personal loan you want will be higher. Hence, the lender will assume a higher risk and ask for a higher interest from you. On the other hand, if you are not having any other monthly repayments, then the risk of default will be lower, and you can get a better rate.

Understanding these factors will help you to get better rates. When you know how lenders determine the rates to be offered to individual customers, you can try to manage your finances responsibly so that you can get the best interest rates the next time you want to take out a loan.

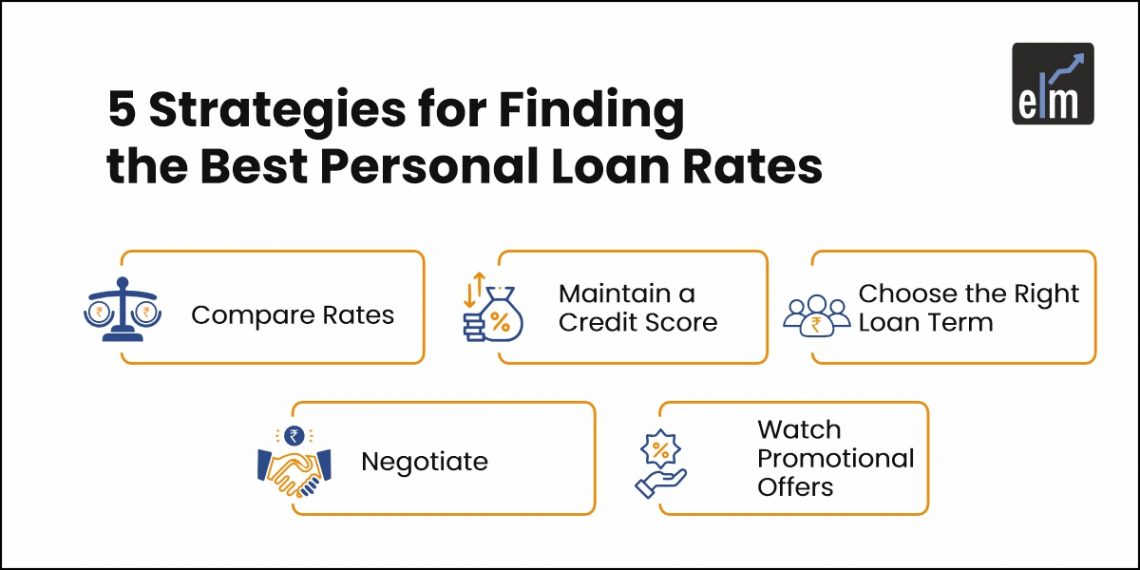

Try these 5 strategies for the best personal loan rates in India

If you’re planning to take a personal loan, securing the best interest rate can save you a lot of money. Let’s take a look at 5 effective strategies to help you secure the best personal loan rates in India!

1. Do Compare Rates across Multiple Lenders

When it comes to personal loans, don’t just grab the first offer you get. It’s easy to overlook this step, but comparing rates from different lenders can save you a significant amount of money. Check with banks, credit unions, and online lenders since they all have different criteria for setting their rates.

Let’s look at a simple example. Imagine you want to borrow ₹5,00,000 for three years. Your bank offers you a rate of 12%. But then you decide to shop around and find another lender offering 10%, and yet another at 9.5%.

Here’s what that means for your wallet:

- If you take the loan at 12%, you’ll end up paying about ₹97,000 in interest over three years. Ouch!

- If you get the loan at 10%, your interest drops to around ₹80,000. That’s a bit better.

- But if you go with the 9.5% rate, you’re only paying about ₹76,000 in interest.

Just by comparing those offers, you could save around ₹21,000. That’s real money you could use for something else!

Pro Tip: You can visit an online portal like Bankbazaar or Credit Mantri to get all the information in one place. These sites will help you save a lot of time in researching for the best personal loan rates.

2. Maintain a Healthy Credit Score

A high credit score can help you qualify for personal loans with lower interest rates. Think of your credit score as your financial reputation; it reflects how reliable you are with money.

Try these simple steps to improve your credit score:

- Pay Off Debts: Reducing your debts can improve your credit score.

- Lower Your Credit Card Usage: Keeping your credit card balances low shows that you manage your credit well.

- Avoid Late Payments: Paying your bills on time is very important for maintaining good credit.

How Your Credit Score Affects Your Interest Rate:

- 750 and Above: You qualify for the lowest interest rates, saving you money.

- 600-749: You might get moderate rates and can negotiate for better terms.

- Below 600: Higher rates or difficulty qualifying for loans may occur.

3. Choose the Right Loan Term

When securing a personal loan, it’s crucial to consider the loan amount and tenure along with the interest rate. Usually, smaller loan amounts come with lower interest rates since they pose lower risk to lenders. A shorter loan tenure can also result in better rates, but it means higher monthly payments.

Let us understand this with an example:

For a ₹5,00,000 loan:

- Longer Tenure (5 Years): Monthly payments are about ₹11,122 at a 12% interest rate, resulting in roughly ₹1,67,000 in total interest.

- Shorter Tenure (3 Years): Monthly payments increase to around ₹16,600 at a lower 12% interest rate, costing about ₹97,000 in interest.

By choosing the shorter tenure, you save approx ₹70,000 in interest. Just make sure that the higher monthly payments fit your budget.

Pro Tip: Use an EMI calculator to see how different loan amounts, tenures, and interest rates impact your monthly payments. This will help you find a loan that works for you.

4. Negotiate or Ask for Better Rates

Many borrowers don’t realize that negotiating the interest rate on a personal loan is possible. If you have a good credit score or a strong relationship with your bank, don’t hesitate to ask for a better rate. Presenting lower offers from other lenders can be an effective way to encourage your lender to provide a more competitive rate. If you find a lower rate from another lender, let your lender know; they might be willing to match or even beat that offer.

Pro Tip: Prepare for your negotiation by gathering all relevant financial information, including your credit score and competing loan offers. This will strengthen your position and make it easier for the lender to consider your request.

5. Keep an Eye on Promotional Offers

Banks and financial institutions have special offers during festive seasons or at the end of the financial year. You may find lower interest rates, fewer fees, or cashback rewards. If you apply for a loan during this period of time, you can secure better terms and save a lot more money!

To take advantage of these offers, check in with your bank or lender regularly to see what promotions are available. Staying informed about these deals can help you save money on your loan.

By following these steps, you can increase your chances of obtaining a personal loan with better rates, ultimately saving you money over time. Remember, being informed and proactive can make a big difference in your borrowing experience.

Frequently Asked Questions

1. How can I get a better personal loan rate?

To secure the best personal loan rates, improve your credit score, compare multiple lender offers, and consider applying during promotional periods. Don’t hesitate to negotiate with your lender, especially if you have a good credit history or competitive offers from other banks.

2. What is the best interest rate for a personal loan?

The best personal loan rates in India is offered by HSBC Bank with an interest rate starting from 9.99% p.a. With a process with up to 2%.

For market updates, visit StockEdge