Have you ever wondered what happens when your favorite company’s promoters pledge their shares?

Suppose the promoters of a company in which you are heavily invested suddenly take out a massive loan.

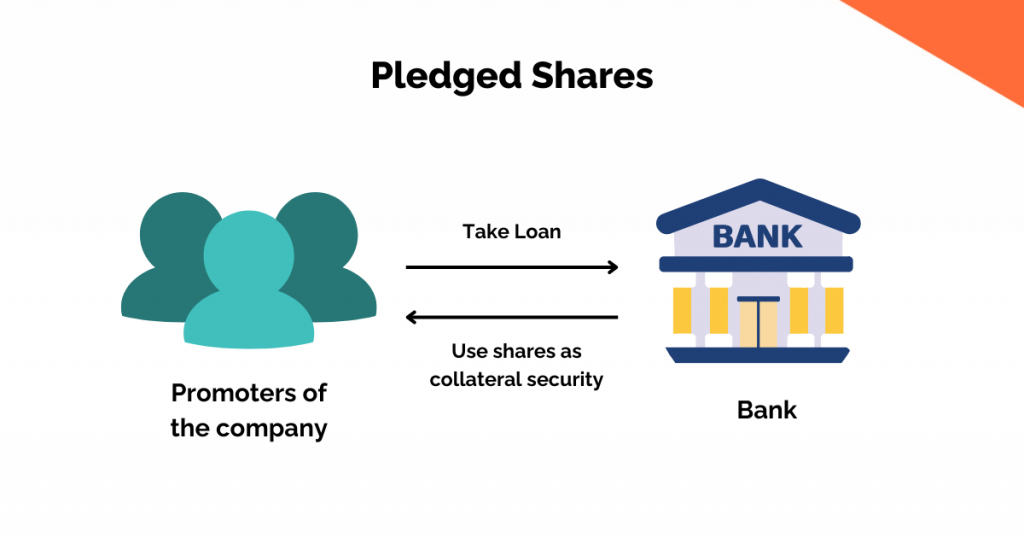

However, they use their stock as collateral rather than selling it. Confused? This is when understanding about pledged shares becomes useful.

When stocks are pledged as collateral for a loan, ownership of the shares is transferred from the shareholder to the lender. Until the loan is entirely repaid, the shares are held by the bank or other financial organization.

It continues to reap the rewards of ownership during this time, including dividends and the ability to vote. But in the event that the borrower fails on the loan, the lender is entitled to recoup the outstanding balance by selling the shares on the open market.

In today’s blog, let us understand what is meant by pledged shares and what are the implications of these shares:

What are Pledged Shares?

Let us understand this by taking an example-

ABC Ltd. is a rapidly expanding technology company.

About twenty per cent of the shares of ABC Ltd. are owned by Ms. Smith, the company’s CEO.

ABC Ltd. wants to expand, but it doesn’t want to issue more shares to dilute its ownership. Therefore, it needs more money.

ABC Ltd. submits a loan application to a bank seeking a Rs. 10 million loan.

Ms. Smith proposes to give the bank a portion of her shares, say 10%, as security for the loan.

The shares that have been pledged serve as security, and the bank approves the loan. This implies that until the loan is entirely returned with interest, the bank has a provisional claim over Ms. Smith’s shares.

Even if the shares are pledged, Ms. Smith typically keeps the corresponding voting rights. Voting rights, however, may be limited by certain loan agreements while the loan is in effect.

Until the loan is returned, Ms. Smith is not permitted to sell the shares that she has promised. The bank is entitled to recoup its money by selling the pledged shares if she defaults on the loan.

Why Shares Are Pledged?

Pledges of shares can have a number of advantages, such as the following:

Obtaining Funds

Offering shares as collateral is a simple and rapid approach to obtain funds without reducing ownership. A commitment to secure a loan for personal purposes, working capital, or corporate expansion can be made by all shareholders.

No Need to Sell Shares

If you need to raise money, you can consider using shares pledged as a substitute for selling shares. The shareholder can keep owning shares and take part in the expansion of the business by pledging them.

Low Interest Rates

Since the lender has security in the form of shares, share pledging may offer a lower interest rate than unsecured loans. As a result, using this arrangement to access funds may be more affordable.

Improved Loan Terms

By pledging shares, promoters and investors can get better loan terms, including longer payback durations and cheaper interest rates.

Benefits for Taxes

Interest paid on loans obtained using pledged shares is deducted from taxes, which may lower the borrower’s taxable income.

How Do Non-Promoters Pledge Shares?

A non-promoter pledge is when someone or anything other than the promoter group of a firm pledges its shares as security for a loan or other funding.

To raise money, finance more investments, or take care of personal financial responsibilities, the non-promoters may pledge shares.

Nevertheless, there are hazards associated with it, such as how stock price changes may affect pledged shares, the threat of losing voting rights, and the potential for margin calls.

Here are steps through which you can pledge shares in icicidirect:

- Verify Eligibility: Not every share can be pledged. To find out which of the shares in your portfolio can be used as collateral, get in touch with your broker.

- Start Pledge Request: To start the share pledging procedure, the majority of brokers provide phone support or online platforms.

- Choose the Quantity and Shares: Indicate the precise shares you wish to pledge as well as the total number of shares.

- Examine and Give Your OK: Examine the pledge agreement’s terms and conditions. The broker will start the process with the depository (such as CDSL or NSDL in India) as soon as you consent.

- Depository Authorization: Through the online portal of the depository, you will receive a message or request to authorize the pledge. Entering a one-time password (OTP) that you received via email or SMS may be required for this.

How do you find out if the company has pledged shares?

Companies routinely provide information about pledged shares to regulatory authorities such as the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) through their databases.

You can locate pertinent filings by conducting a specific company search.

NSE: Corporate Filings and Actions: – Find “Pledged Data” after “Corporate Filings”

BSE: Regretfully, BSE’s website doesn’t seem to have a dedicated area for pledged share data; nonetheless, filings may provide pertinent information.

Frequently Asked Questions (FAQs)

What is a pledge on shares?

A financial arrangement in which a shareholder or business pledges its shares as collateral to get a loan or satisfy other financial demands is called a pledge on shares, often referred to as the pledging of shares.

What is a haircut in stock pledge?

In stock pledging, a haircut lowers the value of assets prior to loan approval as a risk-control tool. It is the discrepancy between the securities’ market value and the value given to the pledged securities.

Conclusion

Pledges of stocks have advantages as well as disadvantages. Positively, it makes cash accessible for a variety of uses, facilitating strategic investments and aiding in liquidity management without the need to liquidate assets. A few promoters take advantage of the dividends paid by the company and use their shares to fund other projects.

Nevertheless, there are a number of possible risks, including a greater danger of margin calls, stock price swings brought on by unfavourable market sentiment, and the possibility of losing business control if repayment proves challenging.

Depending on its intended use, management’s efficacy in overseeing it, and its alignment with long-term financial goals, share pledging may be beneficial or detrimental.