Asset Monetization? You must have heard this term recently when the Finance Minister of India, Nirmala Sitharaman, had announced the National Monetization Pipeline a few days back.

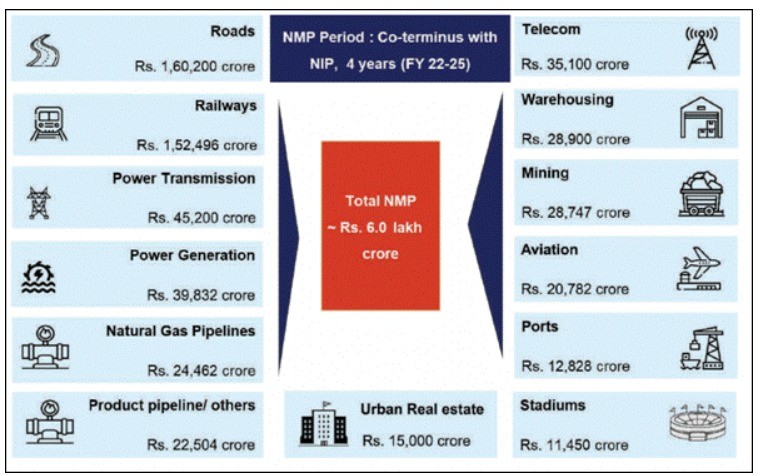

Well, the Government of India has planned to monetize the Government’s assets valued at Rs. 6 lakh Crores over the next 4 years.

I am sure you must be familiar with the word “monetize”. If not, we got you covered! In this blog, we shall decode the not-so-heavy terminology, Asset Monetization, and how the Government is trying to raise revenue through this process.

So, what is meant by Asset Monetization? Let us discuss this in detail:

By Monetization, we mean converting tangible or intangible assets into a source of generating revenue.

Now, having understood the meaning of the word-Monetization, let us see how the assets can be monetized.

So, over time some assets become unutilized which means they become useless and can be rented for generating value.

For example, instead of just selling the roads or highways, the Government can make an agreement with the private entities for a certain period in which the rights of generating income through these roads or highways will remain with the private entity.

So the Government is just leasing its roads to private firms for generating revenue and after a certain period, the Government can take back the ownership of these roads or highways.

This is what the Government of India is trying to do here too! They are renting the unutilized assets so that they generate revenue and invest most of the proceeds in developing infrastructure projects.

Now the question here lies as to how is the Government trying to do this? and what are the assets they are planning to rent out?

How the Government is Planning to Monetize the Assets?

Before we discuss this, one should note that the Government is not selling their assets but just leasing them out for generating revenue for a certain period.

The main objective of this program is unlocking investments’ value of the public sector assets for generating long-term patient capital that can be used for further public investments, mainly in infrastructure projects.

Press Information Bureau

This is not something new for the Indian Government as they monetised assets in the past too.

For example, the Government in the last 24 months has raised Rs 17,000 crores by the NHAI using Toll-Operate-Transfer (TOT) and also another Rs 5000 crores in the upcoming infrastructure investment trusts (InvITs) which sums up to a total of Rs. 22,000 crores.

The above data can help us understand how the National Monetization Pipeline program launched by the Finance Minister is going to help in generating revenue for the Government.

Having understood how the Government has planned on monetising its assets, you must be wondering as to what type of assets and in which public sectors are going to be monetized. Fret not, we shall give you all the basic details so you can share this knowledge (*Read* blog) with others too!

What are the assets that the Government is Monetizing?

The main three sectors in which the Government is planning for asset monetization are the road sector, railways and power sector.

Other sectors include Power Generation, Natural Gas Pipelines, Urban Real Estate, Telecom etc

You can also read our ELM School Module on Real Estate

Below is the Sector-wise Monetisation Pipeline over FY 2022-25 (Rs crore):

Bottomline:

As we discussed above, this is a great process to fund infrastructure development in the economy and give the economy a boost by internally monetizing its unutilized assets and generating a good chunk of revenue. Looks like we are moving closer to our dreams of India becoming a super-power in the world!

Let us know whether you liked this blog or not by commenting below, and if you liked our content then please do share this article with your friends and family to help them understand Asset Monetization.

For stock related queries visit web.stockedge.com

Happy Investing!

Very nice article, very much pleased & thankful for the same.

Hi,

We really appreciated that you liked our blog.

Keep Reading!

SIMPLY.AWESOME LOVE THE WAY YOU DESCRIBED

Hi,

We really appreciated that you liked our blog.

Keep Reading!