Key Takeaways

- Time Horizon: Choose stocks based on whether your goal is short-term, medium-term, or long-term.

- Investment Strategy: Pick a strategy that suits your style: value, growth, or income investing.

- Check Fundamentals: Always analyze P/E, D/E, and P/B ratios before buying any stock.

- Peer Comparison & Holdings: Compare with peers and check promoter, institutional, and mutual fund holdings.

- Size & Dividend History: Align company size with your risk profile and check past dividend payouts.

- Growth & Volatility: Look for consistent revenue growth and understand how volatile the stock is.

When you decide to buy a stock for investing purposes, it is important to do your homework as you are investing your hard-earned money into it. Your goal should be finding good value especially when you are buying a stock for the long term.

But before you put your full faith in a company, you should do thorough research, analyze stock’s fundamentals and check if that stock fits in your portfolio before buying a stock.

You are not just buying a stock but you are becoming a shareholder of that company, so as an investor you should be doing the proper analysis.

Here are ten key factors you should know about a company before buying a stock and investing your hard-earned cash.

1. Time Horizon:

Firstly, you need to decide the time horizon before buying a stock as it plays a crucial role in deciding whether to buy that stock or not. Your investing time horizon can be short term, middle term or long term, based on your financial goals.

- Short Term- A short-term time horizon is any investment that you are planning to own for or under one year. If you’re planning to buy a stock and hold it for under a year, then it is best to invest in stable blue-chip stocks which pay dividends. The companies have a good balance sheet and there are fewer risks involved.

- Medium Term- A medium-term investment is an investment that you want to hold from one year to 10 years. For middle term investing one should invest in quality emerging markets stocks and stocks having a moderate level of risk.

- Long Term-Finally, long-term investments are any investment that you are planning to hold onto for more than 10 years. These investments have time to recover if something goes wrong and can generate a significant return.

2. Investment Strategy:

Before buying a stock, it is important to study various investing strategies and choose the one which suits your investing style

Below are three key types of strategies that are used by most successful investors:

- Value Investing: Value investing is the type of investing in stocks that are undervalued compared to their peers in hopes of generating gains. This is the strategy that is used by Warren Buffett to make huge profits.

- Growth Investing: Growth investing is the type of investing in stocks that display market-beating growth in terms of revenue and earnings. Growth investors believe that the upward trends in these stocks will continue and create an opportunity to generate profits.

- Income Investing: Finally, investors should look for quality stocks that pay significant dividends. These dividends generate income that can be used or reinvested for increasing earnings potential. Thus, before buying a stock, you should consider the strategy that fits in well with that investing style.

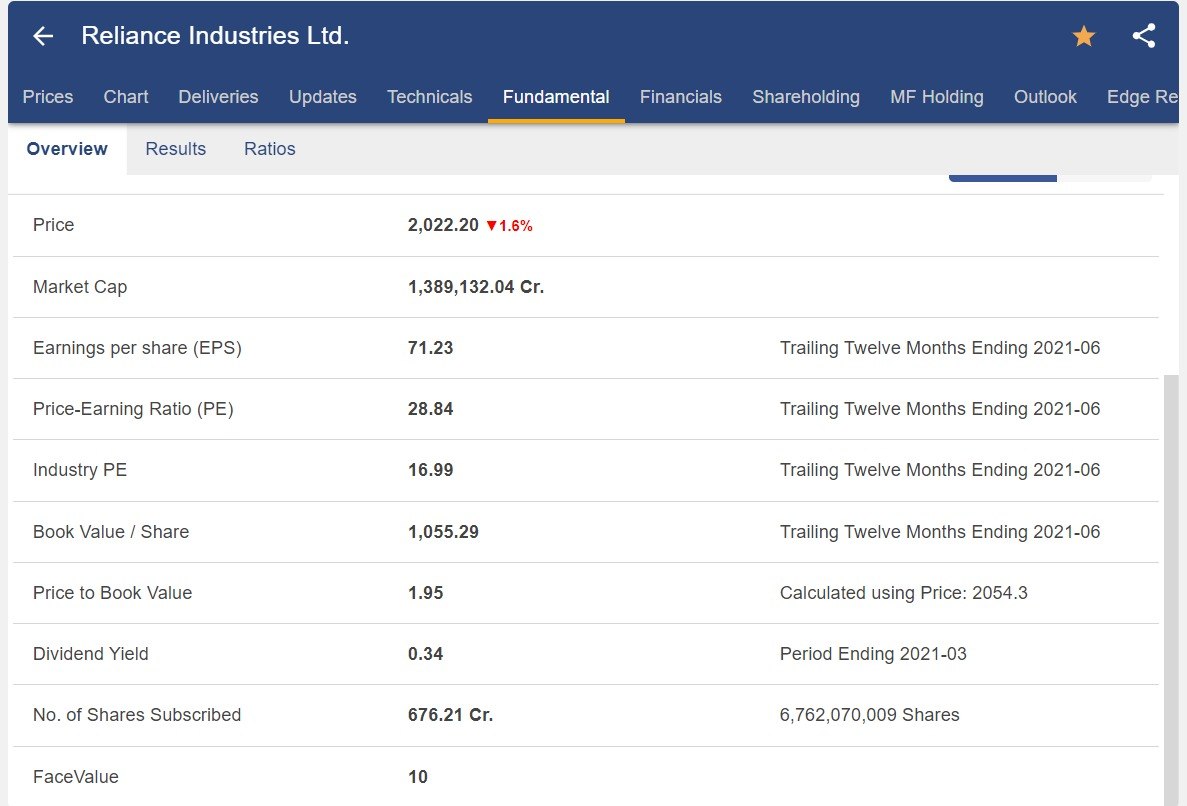

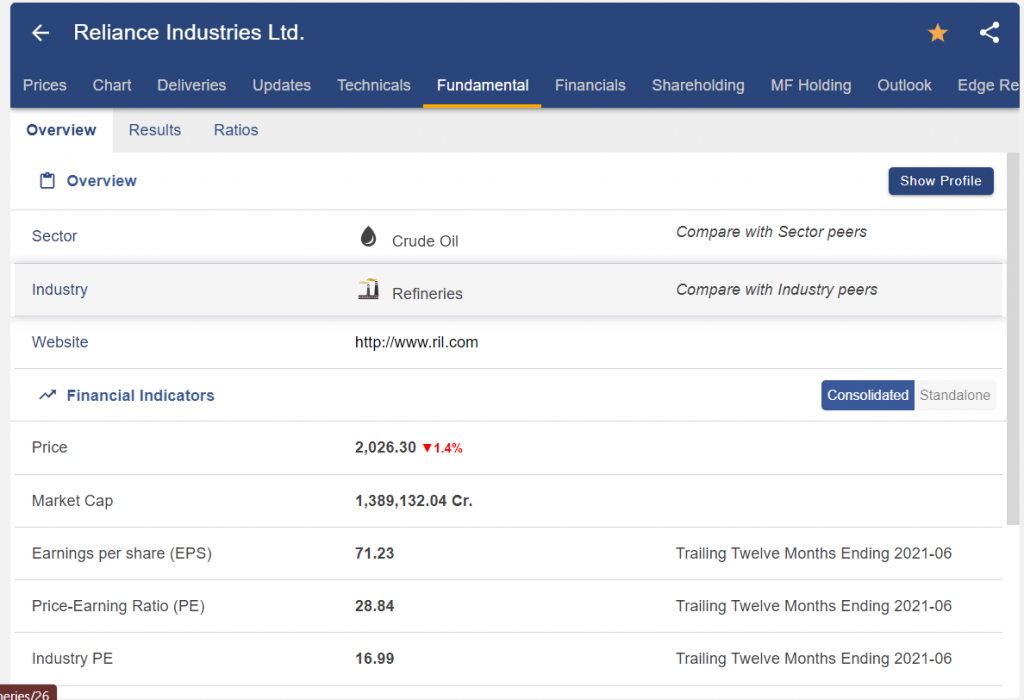

3. Check Fundamentals before buying a stock:

Investors should check fundamentals before buying a stock.

Famous investors like Warren Buffett made a lot of money by comparing the current market price of stocks to their fair market value. According to him, an undervalued stock will reach its fair, or intrinsic value.

Some of the most important ratios to consider before buying a stock:

- Price-to-Earnings Ratio (P/E Ratio)- P/E ratio compares the stock’s price with the company’s earnings per share (EPS). For example, if a company is trading at Rs. 20 per share that produces EPS of Rs. 1 annually, then its P/E ratio is 20 which means that the share price is 20 times the company’s earnings on an annual basis.

- Debt to Equity Ratio- The debt-to-equity ratio helps in determining how much the company is in debt. High levels of debt are bad as it signals bankruptcy.

- Price-to-Book-Value Ratio (P/B Ratio)- P/B ratio ompares the stock’s price to the net value of assets that are owned by the company, and then divided by the number of outstanding shares.

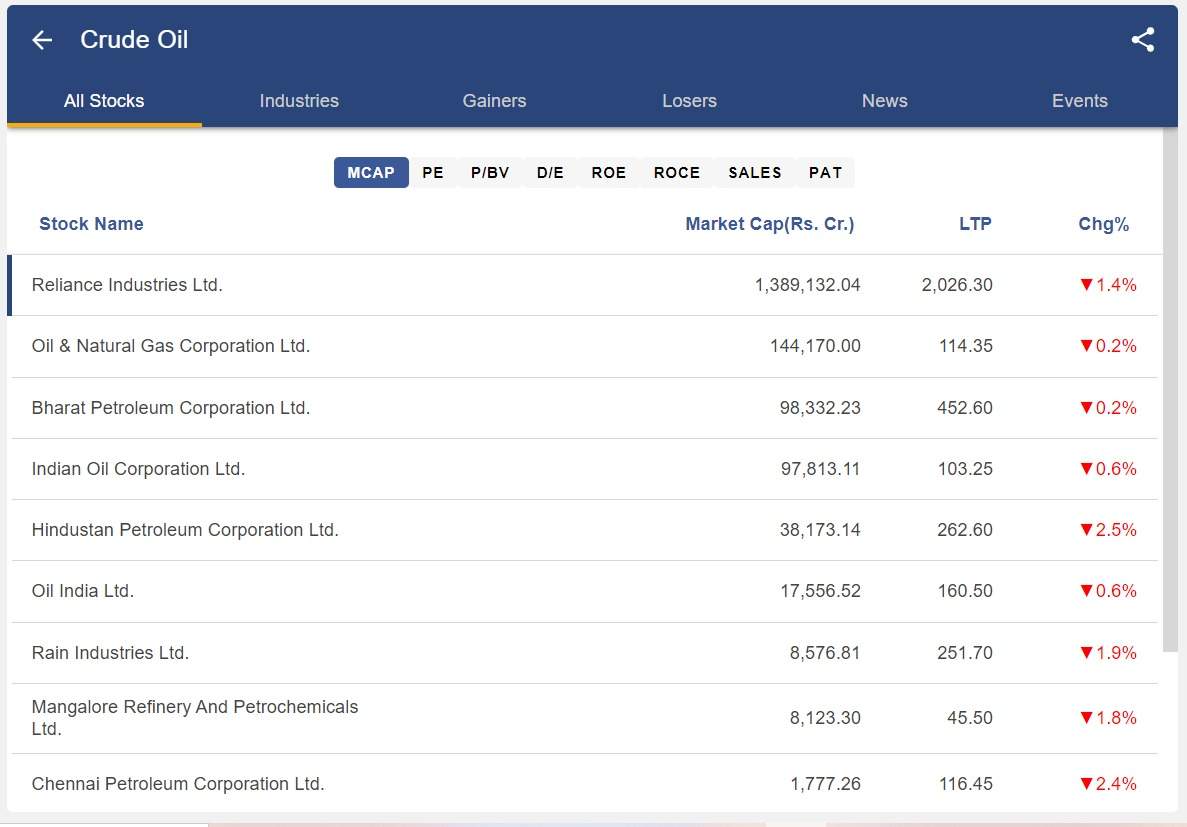

4. Stock Performance compared to its peers:

Investors should also check how the stock has performed in comparison to its peers, websites like StockEdge and Google finance help the companies to compare with their peers.

5. Shareholder Pattern:

Investors should check the shareholding pattern before buying a stock.

Promoters are entities that have a major influence on a company. They may have a huge controlling stake in the company or hold senior executive positions.

Thus, Investors should invest in those companies having a high promoter holding, High Domestic Institutional Investor holding and also High Foreign Institutional Investor holding.

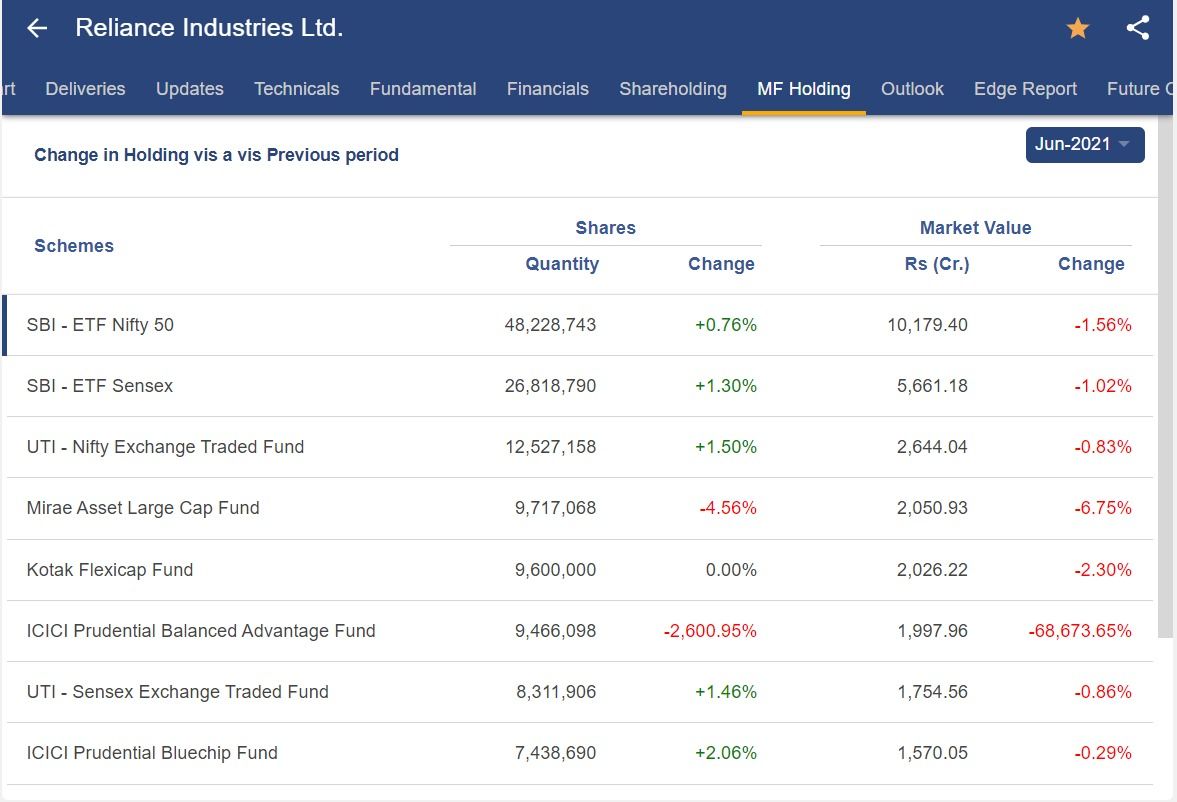

6. Mutual Funds Holding:

When a stock is held by many mutual funds, it is generally considered a safer stock compared to the other stocks which are not held by any mutual funds.

7. Size of the Company:

The size of the company that you are considering investing in plays a crucial role in the amount of risk that you want to take for buying a stock.

Therefore it is important to consider the company’s size compared to your risk tolerance and time horizon before buying a stock.

The size of publicly traded companies can be determined by looking at the company’s market capitalization as shown below:

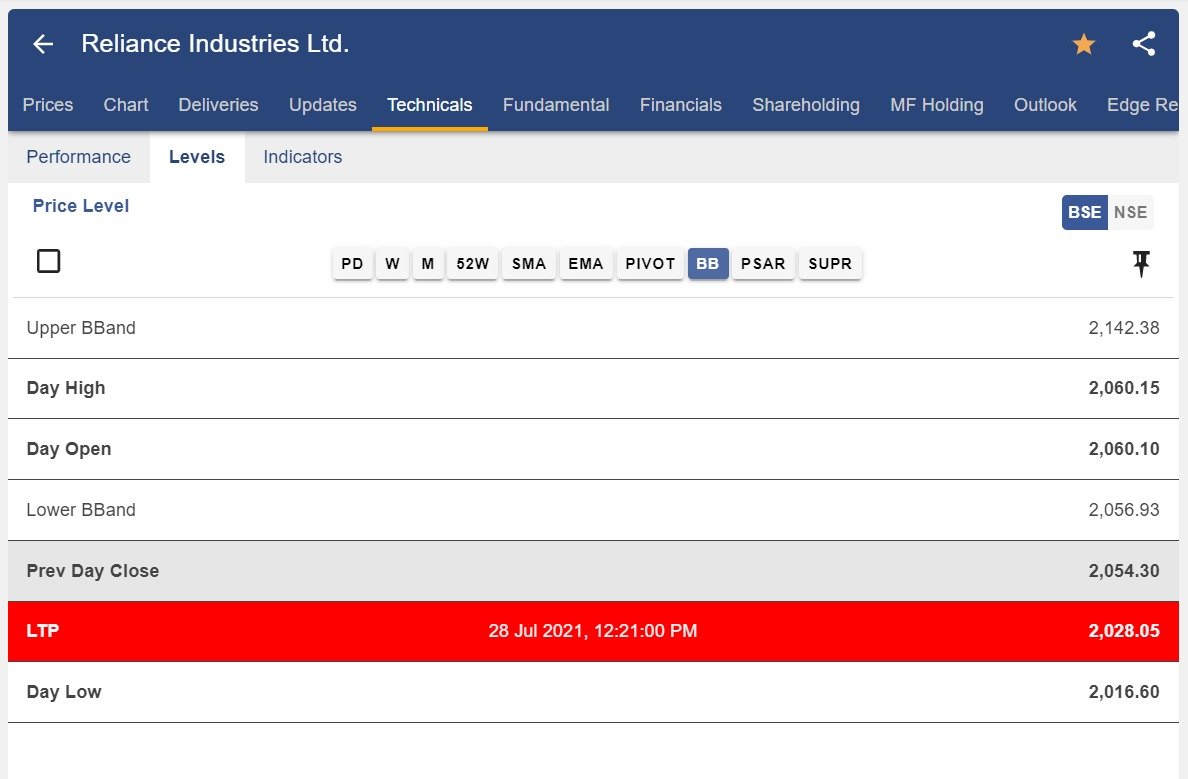

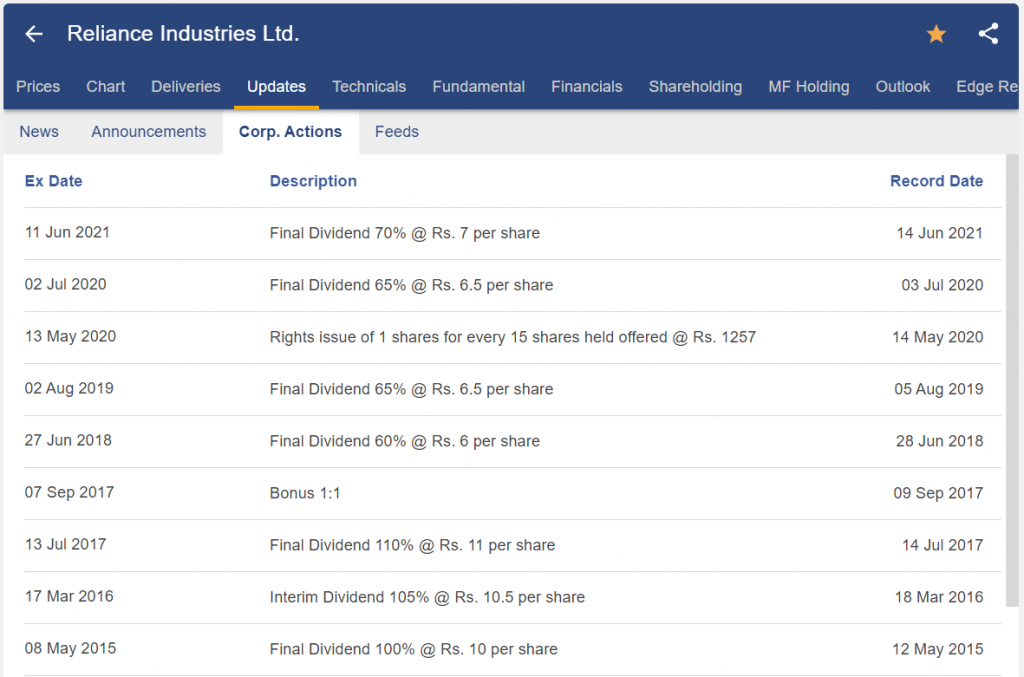

8. Dividend History:

Dividend stocks are known for giving a part of their profits to their investors in the form of dividend payments.

Investors who follow the income investing strategy should try to invest in these dividend stocks.

If the investor’s goal is to generate income through their investments, then they should look into the dividend history of the company before buying its stock.

Income investors who are looking for a high level of income compared to the stock’s price should look at the company’s dividend yield that is expressed as a percentage.

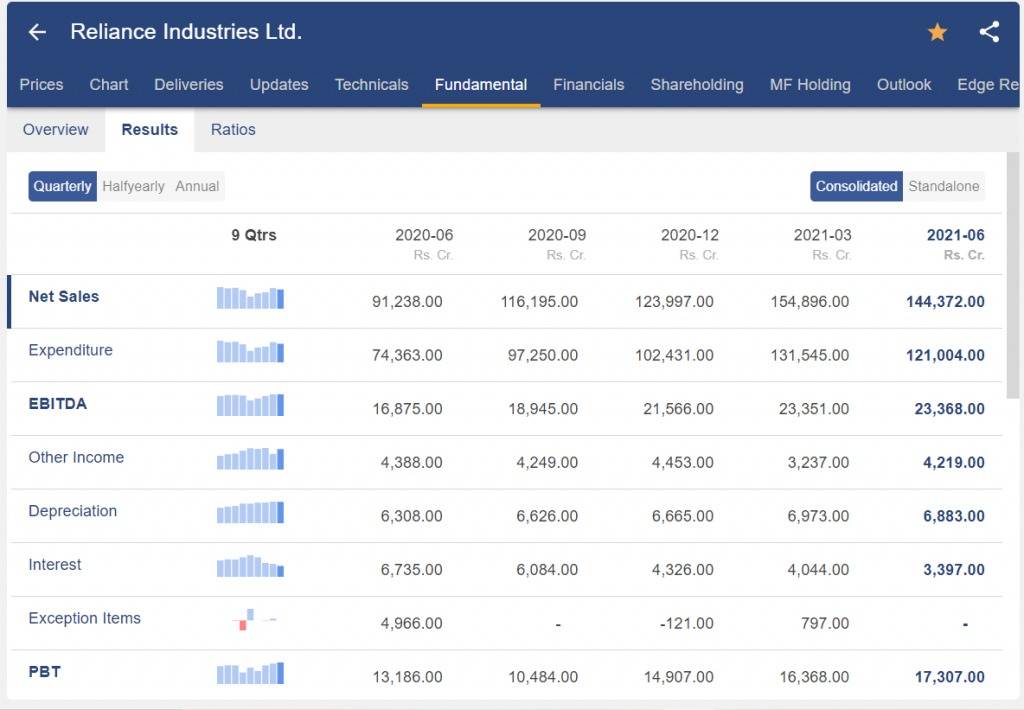

9. Revenue Growth:

Before buying a stock, investors should look at those companies that are growing. This can be determined by checking both its revenue and its earnings.

10. Volatility:

Stocks with high levels of volatility will rise quickly on bullish days, and fall like a brick on bearish days.

If you invest in a low-volatility stock that moves slowly and a recent uptrend begins to reverse, then you can take in on your profits before they disappear.

On the other hand, stocks that show fast-paced movements do not give you much time for exiting the investment and when a trend reverses then it could lead to losses.

The Stock Market has a steady inflow of newbies every year. This is especially true in the case of India, with Gen Z taking an active interest in Money-making. Influencers have taken to various Social Media channels, disseminating their knowledge on creating Wealth earn consistently. Today, the youth is more interested in the Best Stocks to Buy, Best Courses for Stock Market Beginners, Best strategies in Stock Market to create Wealth. As a result, newbies actively start trading, more often than not without sound knowledge.

You can also watch our video on how to start trading in the stock market:

Bottomline:

Before you buy any stock and add them to your portfolio, you should make sure that you should buy the best companies. Stock screeners like StockEdge can help you in filtering the companies which meet your investment or trading requirements.

New to investing? Explore our comprehensive stock market courses for beginners. Learn essential strategies and build a strong foundation today!

Happy Investing!

Good basic suggestion for a new investor in stock market.

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!