Why don’t we improve the return on investment of our portfolios this Holi, Since Holi is all about the destruction of evil and celebrating success by playing with colors?

So let’s take this opportunity to look at ways to get rid of the evils in our portfolio too and be able to identify mutual funds and stocks which improve the return on investment and add success to our lives.

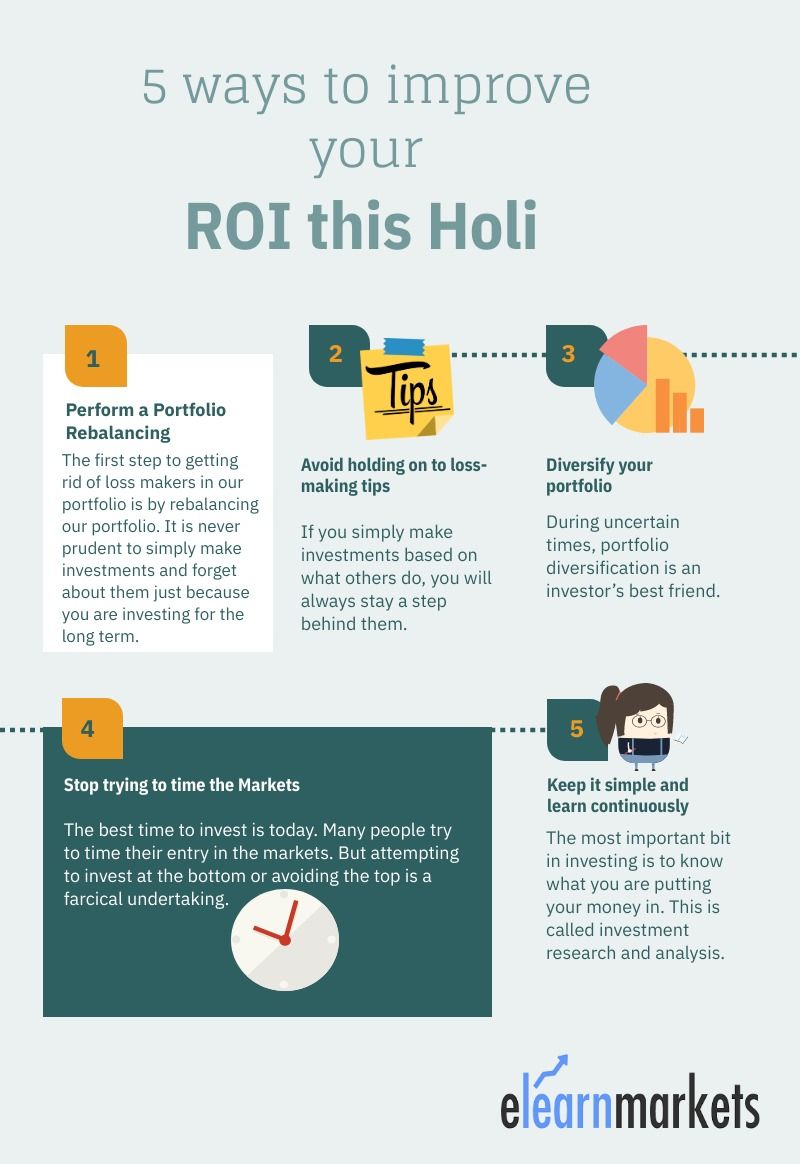

Below are ways to improve your Return of Investment this Holi:

1. Perform a Portfolio Rebalancing to improving the return on investment

The first step to improving the return on investment is by rebalancing our portfolio. It is never prudent to simply make investments and forget about them just because you are investing for the long term. Portfolio rebalancing is where you minimise your risks and realign your portfolio with your goals.

Assume Vaibhav invested Rs.10,000 each in 2 mutual funds, SBI mutual fund and HDFC mutual fund. After 2 years, his investment is worth Rs.40,000. His returns from SBI fund is Rs.14,000 while from HDFC is Rs.6000.

So now his portfolio weightage has changed with SBI Fund investment worth Rs.24,000 and HDFC fund investment worth Rs.16,000. So around 60% of his portfolio is invested in 1 mutual fund. If this particular mutual fund was to fall in the coming years, it would significantly reduce his returns. So this is when Vaibhav should rebalance his portfolio and adjust his holdings based on his goals and risks. This will help improve the return on your investments.

2. Avoid holding on to loss-making tips

Many investors purchase shares and mutual funds based on advice from friends, tv personalities and other investors. This is like buying a car without a steering wheel. It is important to have control over your investments by knowing what you invest in. If you simply make investments based on what others do, you will always stay a step behind them. This has a serious impact on our return on investment.

Without knowing about the fundamentals of a company, you will be unable to assess if the stock would gain strength again if it falls. This could result in serious losses. Shares of Yes Bank and Jet Airways are perfect examples of such a problem.

One of the best ways to improve your returns is to invest in financial instruments that you understand.

3. Diversify your portfolio to improving the return on investment

Just like Holi is about many colours, our portfolios too should have a mix of different asset classes and mutual funds. During uncertain times, portfolio diversification is an investor’s best friend and is what improves the return on investment.

The reason is that each asset class reacts differently to different events. For instance, during the peak of the Covid19 pandemic, global stock markets witnessed 40% drawdowns due to world wide lockdowns. Soon an asset class like Gold began setting new highs and made an all time high a few months ago.

Examples of asset classes one can have in their portfolios are fixed income instruments like bonds, precious metals, international stocks and real estate.

4. Stop trying to time the Markets

The best time to invest is today. Many people try to time their entry in the markets. But attempting to invest at the bottom or avoiding the top is a farcical undertaking. Waiting for the stock markets to correct never ends up well. Instead the prices keep going higher and higher. The investor then in panic of missing out invests at very high prices decreasing the return on investment for the first few years.

If you really feel after a thorough analysis that stocks are overvalued, then a good strategy to invest is by spreading your investments over a long time period. Instead of investing all your capital at once, you can invest in chunks over a 6-8 month period.

5. Keep it simple and learn continuously to improving the return on investment:

Many make investing sound like a very complicated and dangerous subject. But in reality investments are most effective when they’re kept simple. The most important bit in investing is to know what you are putting your money in. This is called investment research and analysis.

The financial markets are very dynamic and the prices of various instruments changes every second. It is therefore prudent for investors to not be obstinate. Adapting to changes and learning constantly to stay above others will surely improve the return on investment.

So keep the above points in mind this holi and make the most out of your portfolio. Wishing everyone a very happy Holi and may your portfolio bloom in the time to come.

Check out more articles on StocKEdge blog.