People in stock market usually believe the complex things to be most effective, but however, the things which are simple are found to be a better choice for both in personal life as well as stock-market. One such similar concept we have is Cash Conversion Cycle.

It is a simple yet very effective way to analyze the efficiency of company’s operation.

| Table of Contents |

|---|

| Cash Conversion Cycle |

| Calculation of Cash Conversion Cycle |

| Negative Cash Conversion Cycle |

| Illustration |

| Bottomline |

| Key Takeaways |

Cash Conversion Cycle

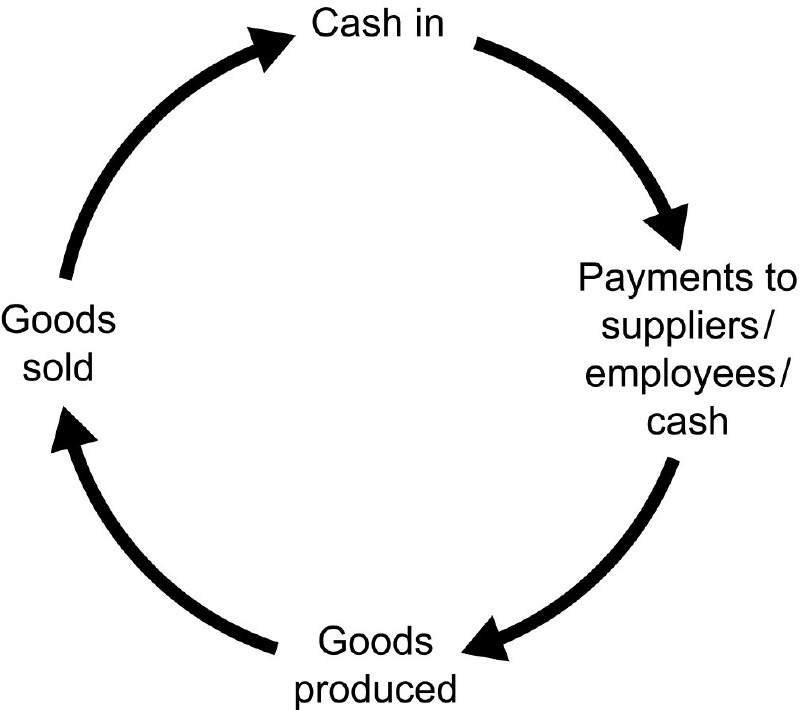

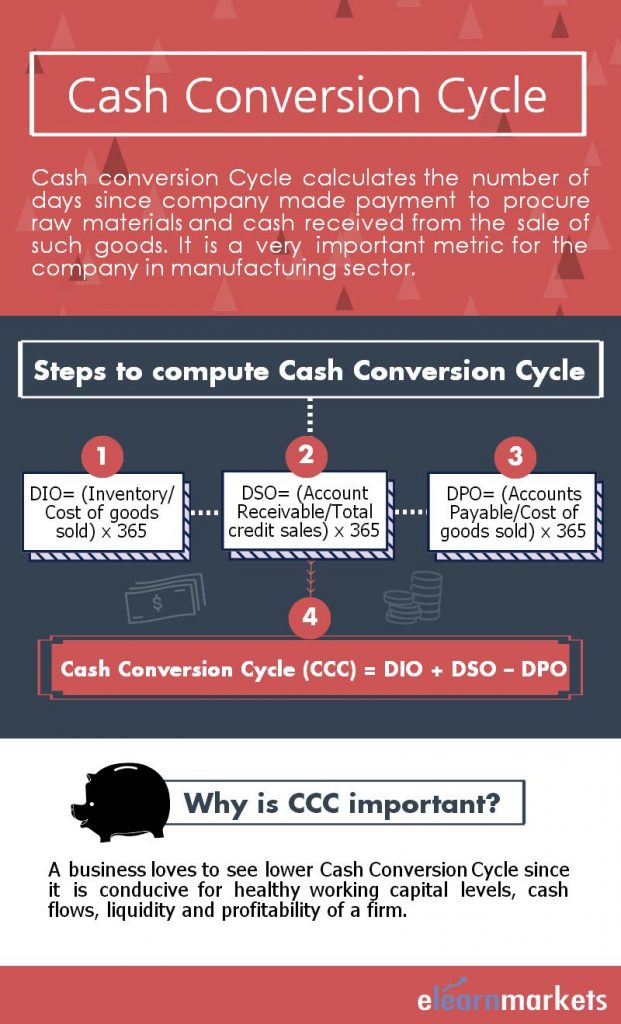

It measures the time period between the cash outlay and the inflow of cash i.e. it calculates the number of days since the company made payment to procure raw materials and cash received from the sale of such goods. In simple words, it measures the time period for which the funds are tied up in the business. It is a very important metric for any company in the manufacturing sector.

Calculation of Cash Conversion Cycle

It is calculated by summing up Days Sales Outstanding and Days Inventory Outstanding and subtracting Days Payable Outstanding. The shorter the value, better is for the company.

Now, we will understand how to calculate the above three figures.

1. Days Inventory Outstanding (DIO)- It measures how fast a company converts its raw material into sales. Lower the better.

DIO= (Inventory/Cost of sales) x 365

2. Days Sales Outstanding (DSO)– It measures how quickly a company receives cash from its customers. Lower the figure, better is the company’s operation.

DSO= (Account Receivable/Total credit sales) x 365

3. Days Payable Outstanding (DPO)– It calculates how quickly a company makes payment for its purchases. Unlike the first two figures, a company would want its days payable outstanding to be higher.

DPO= (Accounts Payable/Cost of sales) x 365

Negative Cash Conversion Cycle

There are few companies whose business model results in negative cash conversion cycle. It implies that the company is able to manage its working capital in such an efficient manner that on an average it is able to buy its inventory, sell the final product and collect the receivable before the corresponding account payable becomes due. This is an ideal situation for a business.

Once you have calculated the above three figures, you can compute this conversion cycle as follows-

Cash Conversion Cycle= Days in Inventory Outstanding (DIO) + Days in Sales Outstanding (DSO) – Days in Payables Outstanding (DPO)

To know about this cycle in more details you can watch the video below:

Illustration

We can do the calculation in just 4 steps and we need information from the working capital accounts like Inventory, Accounts Receivable and Accounts Payable along with some Income statement items. Let’s take an example to understand this.

Also Read: How to Prepare Income Statement?

Net Revenue 40000

Inventory 2500

Cost of Goods sold 25000

Average Receivables 850

Average Payables 1000

Step 1: Calculation of Days Inventory outstanding (DIO)

DIO= (Average Inventory/COGS) x 365

= 2500/25000 x 365 = 37 days

Step 2: Calculation of Days Sales outstanding (DSO)

DSO= (Account Receivable/Total credit sales) x 365

= 850/40000 x 365= 8 days

Step 3: Calculation of Days Payable Outstanding (DPO)

DPO= (Average Payable/COGS) x 365

= 1000/25000 x 365 =15 days

Step 4: Calculation of Cash Conversion Cycle (CCC)

CCC = DIO + DSO – DPO

= 37 + 8 – 15 = 30 days

It implies that the company takes approximately 30 days on an average to purchase its inventory, make payment to suppliers, collect the receivables, and receive cash.

Bottomline

Cash conversion cycle is an important metric for a business to determine the efficiency at which a company is able to convert its inventory into sales and then into cash.

A business loves to see lower value of this cycle since it is conducive to healthy working capital levels, cash flows, liquidity and profitability of a firm.

In order to get the latest updates about Financial Markets visit https://stockedge.com/