| Table of Contents |

|---|

| What is Marubozu Pattern? |

| Marubozu Pattern Formation |

| Bottomline |

What is Marubozu Pattern ?

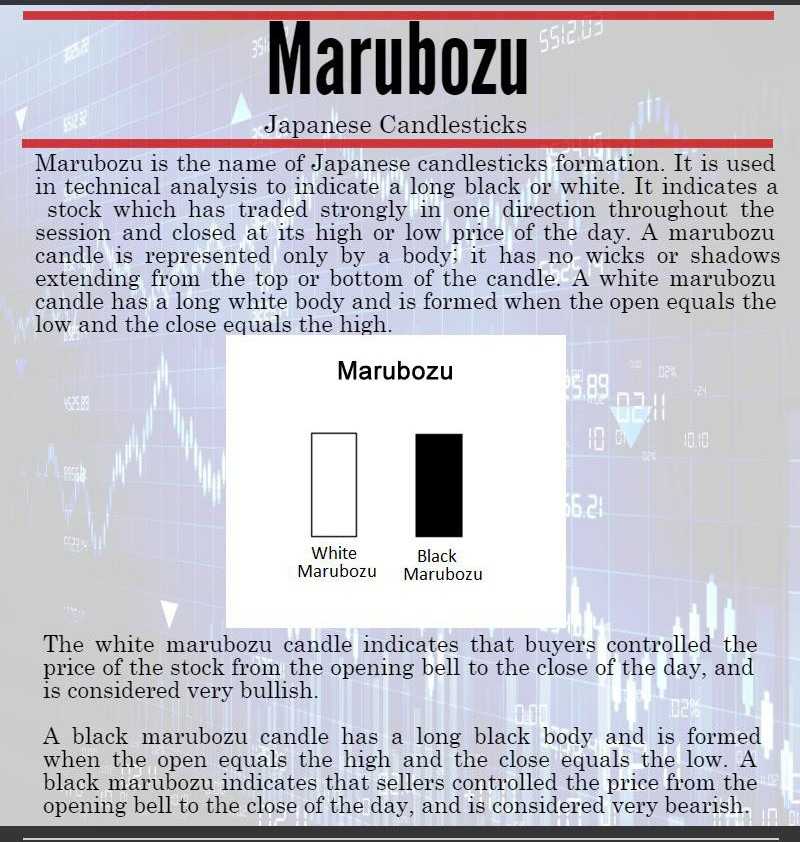

The term Marubozu pattern can be translated into Japanese as “Close-Cropped” or “Shaven-Head”. It is a type of candle-stick pattern which has no upper or lower shadow.

If a candle has no lower shadow, we can say that it has a shaved bottom.

If a candle has no upper shadow (also known as wick), we can say that it has a shaved top.

Also Read: Japanese Candlestick Pattern: MARUBOZU

The interpretation of the Marubozu pattern can depend on the color of candlestick formed.

If it is a long white line pattern or a long black like pattern, it basically means a very bullish day or a bearish day.

In case of a bullish day, if it is a long white (or green/blue) candle then it depicts an UP day.

On the other hand, in case of a bearish pattern, if it is a long black(or red) candle, it depicts a DOWN day.

In a bullish Marubozu, the opening of the candle is very close to the low of the day.

The price keeps on going higher during the day and finally closes at or near the high of the day.

The range between the high and low is very large.

Learn from Experts : How to Trade with Candlesticks?

In a similar way, a bearish Marubozu opens near the high of the day and keeps falling to close near the low of the candle.

The qualification of a marubozu candle can only be determined in comparison to the candles immediately preceding it.

For example, if the Marubozu appears as a long day in a very quiet and subdued market, it may be far less long compared to the candles that will precede it in a volatile market.

As the typical trading range for a day in a volatile trading day is much higher.

As a general observation, for a candlestick to qualify as a Marubozu, the body of the candle should be at least three times the size of the previous day’s candle.

If we look at the recent Marubozu candlestick patterns that formed in the Indian stock market lately, we can see the following stocks:

To know about other candlesticks, read our blog on All 35 Candlestick Chart Patterns in the Stock Market-Explained

Marubozu Candlestick Formation

Reliance

A Bearish Marubozu pattern formed in the daily chart of Reliance Industries Ltd. on 20.08.2015.

As we can see here, there is no upper shadow in the candle and very negligible lower shadow.

The body of the candle is more than three times the size of the previous day’s candle.

The bearish implications of the candle can be further confirmed by the gap down in the stock the next day.

Cipla

The bearish marubozu formation on 17.08.2015 in Cipla is another example worth mentioning.

The candlestick formation was accompanied by high volumes.

Its body is longer than three times the size of the candle of the previous day and has negligible upper or lower shadow.

It has also formed a bearish engulfing pattern that day.

Also Read: OUTSIDE DAY: Bearish Engulfing and Bullish Engulfing Patterns

With all these confirmations along with the candle of the next day breaking down below the low of the marubozu, the bearish implications panned off the following days when the stock succumbed to the levels of 630 from the levels of 740 six days ago.

Bottom Line

In this article, we have tried to help you to gain an understanding of the Marubozu Candlestick Pattern.

In order to know more about Financial Markets visit our website stockedge.com

Feel free to give your feedback by writing to us in the comment box below.

Happy Learning!!

A vertical formative lesson about Marubozu candle,the given example in this lesson is perfect ,thank you

A very informative lesson about Marubozu candle,the given example in this lesson is perfect ,thank you