When we talk about purchasing a stock, what is the first thing that should come to your mind?

What is the quality of the stock?

This quality can be assessed based on several factors and one such important factor is evaluating the management of the company.

A stock for a long-term investor should be treated as a part of a company or a business. So, if the business does well, there is high probability of your stock doing well.

The business does well when the management running the business consistently do great work and take the company to greater heights.

The retail investor holds just a minuscule share in the company’s total capital and largely depend on the decision-making pattern of the management of the company.

Now the harsh truth is, even if a company is doing well, its finances are good, valuation is appropriate. There is no guarantee that the retail investors will reap benefits out of company’s profits.

Here’s why?

The promoters in the event of fraudulent activities get rid of their shares before the fraud becomes public information. Thus, the investors should be on the lookout for every red flag in management’s decision making.

The promoters may siphon money away through subsidiaries.

One such hypothetical case would be:

Company X is a good business which has growing revenue and profit year-on-year. It has low debt, healthy cash balance. Company Y acquires company X by buying majority of shares (above 50%).

Next thing what can happen is, the cash balance and further profits of company X is given to company Y as loans.

In this way the accumulated surplus of company X is taken over by company Y. And retail shareholders of company X are the biggest losers here.

Such instances have actually happened with real companies.

One way to detect such instances would be to study the “related party transaction” carefully and if any suspicious transaction takes place, it is better to sell the shares before it’s too late.

The management may not distribute dividend and may acquire other non-profitable businesses or diversify into bad businesses thus destroying the accumulated wealth.

Thus assessing management carefully before investing in stocks is a necessity.

1. Check Promoter’s Background

Checking promoter’s background means checking the management’s strategy, past track record and determining whether they are in best interest of all shareholders. If there are any activities that prove attempts of siphoning investor’s or creditor’s money then one should stay away from such company.

One of the easy ways to check promoter’s background is simply typing in google and reading information available in public domain.

Look out for any disputes with SEBI or other regulators.

Anything that questions the integrity and character of the promoters should be looked with suspicion. Further study should be done to confirm or dispel doubts about the news or allegations.

2. Salary of Key Managerial Persons (Promoter or Management)

A company can pay any remuneration by way of salary, dearness allowance, perquisites, commission and other allowances not exceeding 5% of its net profit for one managerial person. If there is more than one managerial person, then managerial remuneration cannot exceed 10% of net profit for all of the managerial persons together.

Data on management’s remuneration is available in the “Annual Report” of the company. You can do a study of year-on-year along with percentage of profits. If the salary increases abnormally then that can raise a red flag.

There should not be a situation where the profits do not increase but salary increases disproportionately. This could be a red flag for shareholders.

Example:

Apollo managing director Neeraj Kanwar has been compensated handsomely even at a time when the company has performed poorly. Kanwar’s remuneration has outpaced the growth in revenues and profits for the past five years.

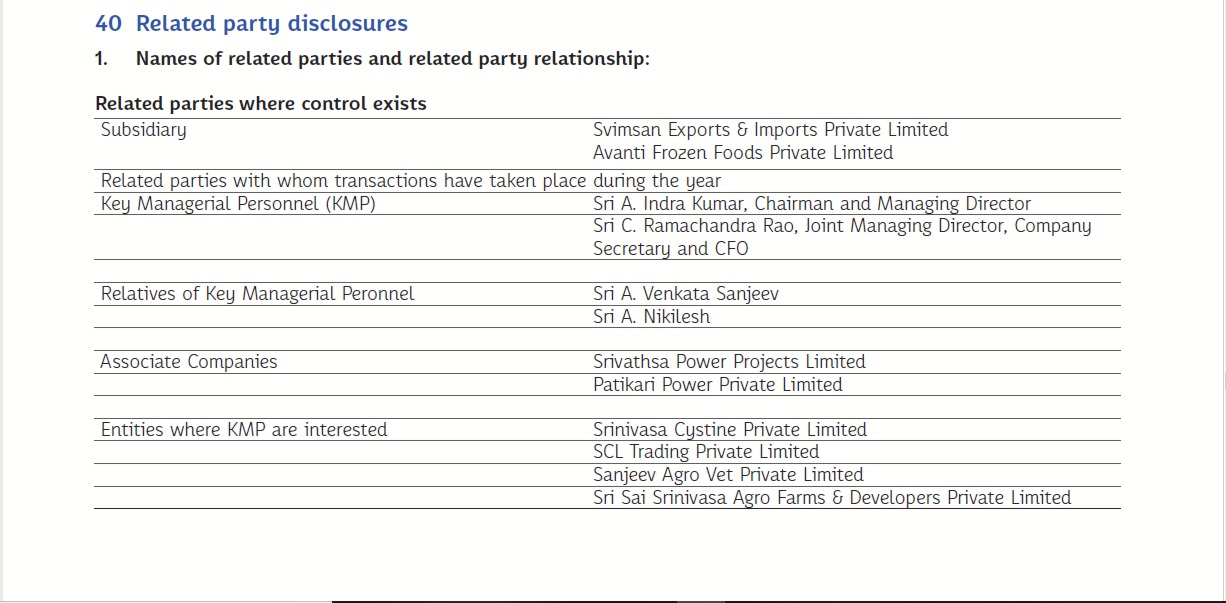

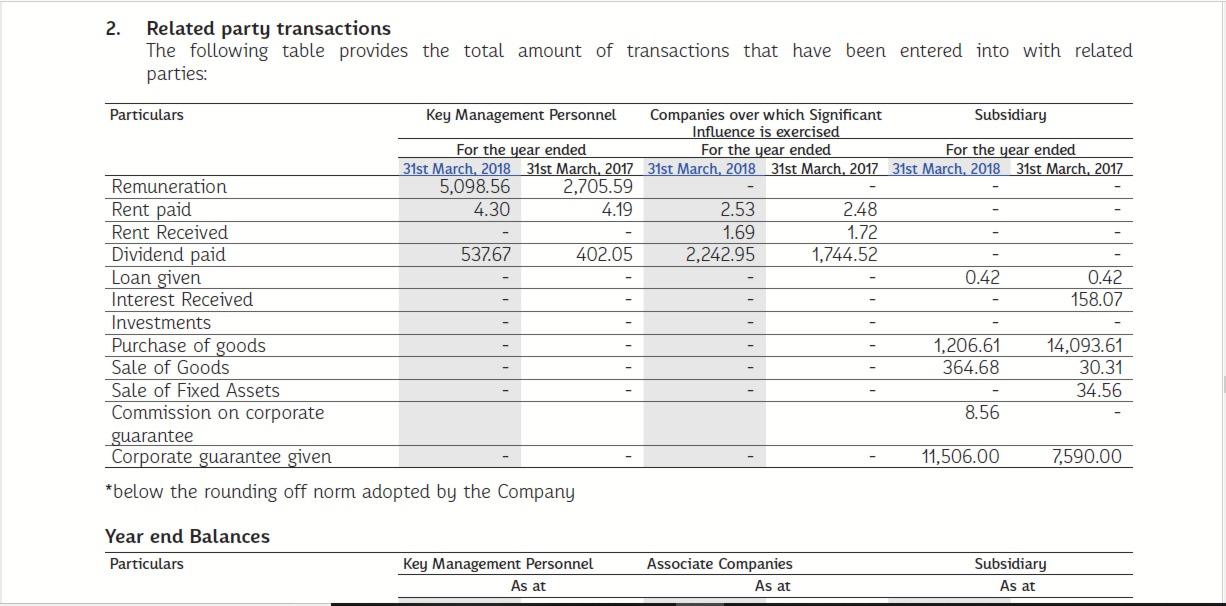

3. Related Party Transaction

Related Party Transaction is one of the most important section of annual report to look at for assessment of management.

This section represents the transaction that the company had with promoter’s other entity or their relatives’ entity, joint ventures, etc. This is the most preferred route to siphon money from the company to benefit the promoter’s and family at the cost of minority shareholders.

Each item in “related party transaction” should be detailly studied and analyzed.

Source: Annual Report of Avanti Feeds Ltd.

Source: Annual Report of Avanti Feeds Ltd.

Example:

Fortis Healthcare Ltd former promoters Malvinder Singh and Shivinder Singh and other promoters have been ordered by SEBI to return Rs. 472 cr within next 90 days. The Sebi order named RHC holdings, Shivi Holdings Pvt. Ltd, Malav Holdings Pvt Ltd, Religare Finvest Ltd, Best Healthcare Pvt. Ltd, Fern healthcare Pvt. Ltd and Modland Wears Pvt. Ltd. The former promoters diverted money from Fortis to other promoter held entities in the form of advances “secured loans”.

This is a clear case how promoters cheat retail investors through promoter or relatives held entities.

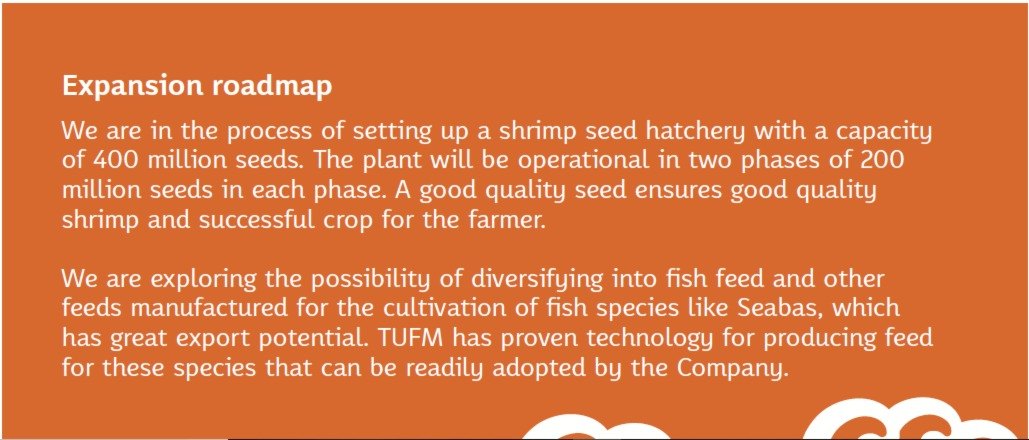

4. Management Presentation and Forecast

In annual report of every company there are plans and projections about the future of the business. Where the management wants to take the company in near-term and long-term.

The sections where these can be particularly found are “The Directors Report”, “Management Discussion and Analysis”. There are “Investor presentation” usually present in the website of the company under “Investor” section.

The announcement and description of new projects if any, increase in production capacity, change in production units, foraying into new markets, introducing new products, sales projection, profit projection, etc.

This is a future projection of Avanti Feeds from its Annual Report (FY:17-18)

The management strategy can be assessed from here.

Then there are quarterly results and conference calls taken by the company management at every quarter. As an analyst one should compare the projections and actual results achieved in the given time-frame.

Look for any strategic changes by the management. You can even participate in the conference call as an analyst or as an investor and ask your own queries.

5. Management’s obsession with share price

Share Price of a company is a function of market forces and ultimately a reflection of company’s performance and future prospects.

But, in shorter term the market does not behave in any predictable fashion. There are too many factors affecting markets at any given point of time. Thus it cannot be predicted with accuracy and consistency.

If the decision-making of the management is influenced by fluctuation of its share price, then it could be a matter of concern. The management should ideally keep a long-term view of the company and not worry about short-term hiccups in the price.

6. Dividend Payments

There is a general preference towards dividend-paying stock by a section of investors. While getting a pay-check from time to time pleases us all, there can be a catch for dividend-paying stocks.

Analysts and investors have to find out where the dividend is coming from. Is it being funded by actual profits or is it being funded by borrowed money debt)?

The “Free Cash Flow (FCF)” [FCF= Cash Flow from Operations- Capital Expenditure] should be positive i.e. the company should have surplus left after making capital expenditure. The dividend paying company should have decent “reserves.”

7. Accounting Manipulations

Some companies indulge in providing incorrect and misleading information in its financials through accounting manipulations. They inflate sales, profits, or show incorrect values of assets. Thus, it’s difficult to understand these manipulations.

Few points that analysts should notice that can help detect accounting frauds are:

- Cumulative Operating Cash from Operations and Cumulative Profit after Tax mismatch.

- Free Cash Flow

- Receivable Days (if increasing not a good sign)

- Inventory build up

- Frequent changes in accounting policies

- Abnormal performance

- High cash with high debt

8. Promoter’s stake in business

Promoter’s faith in business can be somewhat assessed by the shareholding of the promoters in the company. Ideally a promoter owning 50% or more stake in a company is comforting for an investor. But this doesn’t mean it has to be compulsorily above 50%.

Increase in gradual shareholding by the promoter is seen as positive because it might hint at good things to come.

Decrease in shareholding by promoter doesn’t necessarily mean something negative. However, continuous reduction would be alarming. If such instances occur, we should look into the company more seriously and find causes.

Also, high FII or Institutional Investor doesn’t necessarily mean everything is ok. Investor should do their own analysis before investing.

9. Don’t rely on awards

Awards also doesn’t necessarily mean a lot and can be misleading.

Satyam Computers received an award for corporate governance just before the fraud was made public.

Bottomline

Assessing management quality takes a lot of searching and reading through a number of materials. But it is an important aspect of fundamental analysis. This exercise can save you one of the major losses.

In order to get the latest updates on Financial Markets visit Stockedge