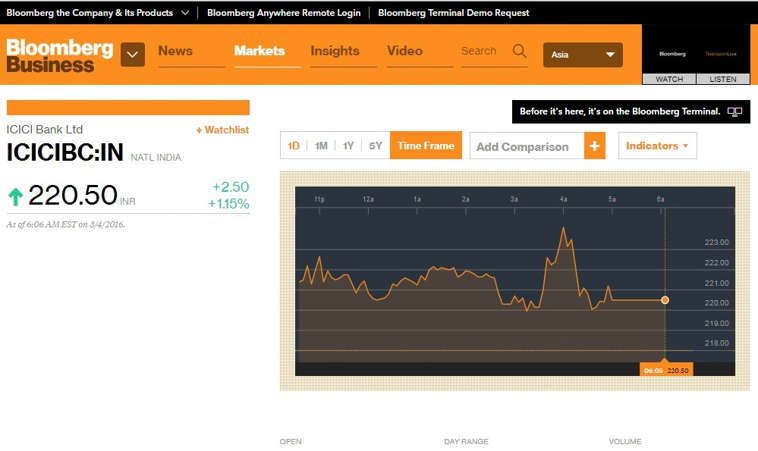

Last week, I met an old friend of mine who often trades in the Indian equity market. He told me that while he was going through the U.S. market, he came across some Indian companies like Tata Motors, Dr. Reddy’s, etc listed on New York Stock Exchange (NYSE). He was very puzzled to see that how a company of Indian origin can be listed on an international exchange. He was totally unaware of the concept of Depository receipts.

I told him that Indian companies can raise foreign currency funds through the issue of American Depository Receipts (ADRs) and Global Depository Receipts (GDRs).

These ADRs and GDRs help companies to tap foreign funds and increase their shareholding base which leads to better share valuation and also creates value for shareholders.

However, most companies go for the GDR route since the accounting norms and other disclosures in the case of GDR are less stringent than the requirements in the U.S.

Let’s understand them one by one.

What are American Depository Receipts (ADRs)?

American Depository Receipts (ADRs) are a way of trading non-U.S. stocks on the U.S. exchange. Through ADRs, Indian companies who are willing to raise funds from the U.S. can do so by issuing shares on the American Stock exchange.

However, the issuance of ADR is governed by the rules and regulations as laid down by the regulator SEC (Securities and Exchange Commission). The Indian Companies will have to maintain accounts as per the American Standards.

The Indian companies cannot directly list their equity shares on the international stock exchange. So in order to overcome this problem; the companies give shares to an American bank. These American banks in return for those shares provide receipts to the Indian companies. The companies raise funds by providing those ADR receipts in the American share market.

How are ADRs created?

Indian companies cannot directly list their equity shares on the international stock exchange.

So, in order to overcome this problem, the companies give shares to an American bank.

These banks will take hold of the stock, and issue receipts to Indian companies in return.

The companies raise funds by providing those ADR receipts in the American share market. These ADRs are listed on the major stock exchanges of the US, like NASDAQ. They can also be sold Over-The-Counter (OTC).

Trading Mechanism of ADRs

One ADR comprises a certain number of shares in an Indian company and these ADRs are quoted in US dollars. The investors of a foreign country can buy and sell shares directly and the investor is free to convert the ADR to receive the equivalent number of shares.

Learn from Expert: Common Sense Investing

For example, an American citizen willing to invest in Infosys limited in the U.S. can do so by purchasing ADR from the listed entity.

As an investor, they will receive all the dividends and capital gains in US dollars, no matter where the original company is from.

What are the Types of ADRs available to Investors?

All ADRs are categorized into two broad categories –

1. Sponsored ADRs

A sponsored ADR is created through an agreement between a non-American company and an American bank.

Here, the company handles all the costs related to the issuing of the receipts in the American markets.

In return, the American bank handles all transactions between the company and the American investors through depository receipts.

These ADRs, like normal company shares, offer voting rights to their holders.

2. Unsponsored ADRs

These ADRs are created by American banks without the involvement or the permission of a non-American company.

Because of this, different banks can issue unsponsored ADRs for the same company as well.

However, since they don’t involve the company’s participation, they are usually traded over-the-counter or OTC.

They also don’t offer voting rights to their shareholders.

These ADRs are further categorized into three more types –

- Type I ADR: These are only to establish a presence in the American market. They don’t permit the raising of funds.

- Type II ADR: These cannot be used to raise funds, but they are permitted to have a higher visibility and trading volume than Type I ADRs.

- Type III ADR: These are a prestigious category of ADRs. The companies issuing these are allowed to raise funds and float an IPO on the American stock markets as well.

What are Global Depository Receipts (GDRs)?

GDRs are similar to ADRs except for the fact that it is listed on an exchange outside the U.S. and helps the issuer to raise funds simultaneously in different markets i.e. it allows the foreign firms to trade on the exchange outside its home country.

These shares are held by a foreign bank that provides depository receipts to these companies in return for the shares.

How are GDRs created?

The process of creating a GDR is quite similar to an ADR.

Companies can approach depository banks of various countries and make an agreement with them.

In exchange for the companies handling the costs associated with trading in different markets, the banks will handle all transactions between the investors and the GDRs of the company.

Trading Mechanism of GDRs

GDRs act as negotiable certificates. Therefore, they are usually traded just like shares of a company in any international market.

A single GDR can represent different amounts of shares, as per the company’s needs and objectives.

GDRs can also be used to raise capital from countries in the form of US Dollars or Euros. When GDRs are traded in Euros, they are known as European Depository Receipts or EDRs.

What are the Types of GDRs available to Investors?

There are two broad categories of GDRs –

1. Rule 144A GDRs

These GDRs are those which operate through the rule 144A of the Securities Exchange Commission (SEC) of the US. This rule allows non-American companies to trade and raise capital in the American Markets.

It also makes these GDRs a cheaper alternative to raising capital from American markets than Level III ADRs.

2. Regulation S GDRs

These GDRs are those which help non-American companies raise funds and establish a trading presence in the European markets only.

These GDRs usually trade on the London or Luxembourg Stock Exchange only and are popularly known as Reg S GDRs. Only non-American investors can trade in Reg S GDRs.

A company can issue both Reg S and Rule 144A GDRs, but they will be subject to different laws.

Differences between ADR and GDR

- American Depository Receipt (ADR) is a depository receipt which is issued by a US depository bank against a certain number of shares of non-US company stock. Whereas Global Depository Receipt (GDR) is a depository receipt which is issued by the international depository bank, representing foreign company’s stock.

- Foreign companies can trade in US stock market, through various bank branches with the help of ADR. Whereas GDR helps foreign companies to trade in any country’s stock market other than the US stock market.

- ADR is issued in America while GDR can be issued in both America and Europe.

- ADR is listed in American Stock Exchange i.e. New York Stock Exchange (NYSE) whereas GDR is listed in non-US stock exchanges like London Stock Exchange or Luxembourg Stock Exchange.

- ADR can be traded in America only while GDR can be traded in all around the world.

- ADR Market is more liquid as compared to GDR market

- Investor’s participation is more in ADR as compared to GDR

- ADR market is a retail investor market whereas GDR’s market is institutional one.

- ADR’s disclosure agreements are more onerous as compared to GDR.

Pros and Cons of ADRs and GDRs

Depository receipts are a unique way of raising funds for companies and a unique investment for diversified portfolios.

However, before we invest in them, we should consider the pros and cons of using ADRs and GDRs for both investors and the issuing companies.

Pros:

- They provide access to investments in the foreign markets, thus becoming a great way to diversify our portfolio.

- They are denominated in US Dollars and Euros, both of which are very powerful currencies to hold investments in.

- Since they are treated like shares, they can easily be traded in markets. They also offer all shareholder benefits to different investors.

- For companies, depository receipts are a great way to attract positive international attention and expand their base of shareholders as well.

Cons:

- Depository receipts are one of the most expensive ways to raise capital for companies.

- Since all transactions are happening in foreign currencies, the investments and capital are subject to the volatility of the foreign exchange or forex market.

- Depository receipts are only suitable for High Net Individuals as high amounts of capital are needed to trade in them.

- There are a limited number of companies which offer their shares in the form of depository receipts, thus leaving lesser choices for interested investors.

Frequently Asked Questions

What is the risk of trading in ADR GDR?

As ADRs are issued by non-US companies, they have risks that is inherent to all foreign investments. One of them is the Exchange rate risk.

What is a depository receipt example?

Indian companies can raise foreign currency funds through the issue of American Depository Receipts (ADRs) and Global Depository Receipts (GDRs).

Through Depository Receipts traders can trade foreign companies in the exchange. For example, Tata Motors can be traded in US Exchange

How do you sell ADR?

Converting your ADR shares into stock shares is a two-step process. The processing agent sells your ADR shares through a U.S. exchange. The processing agent then contacts a licensed broker on the foreign exchange to purchase the company’s stock shares.

How IDR is different from ADR & GDR

Unlike the ADR and GDR, an IDR is issued in the Indian denomination. This gives a chance for the Indian companies to hold a share in the foreign company’s equity.

What is an ADR example?

Through ADRs, Indian companies who are willing to raise funds from the U.S. can do so by issuing shares on the American Stock exchange like Tata Motors

So if you are planning to invest in a foreign company, you can do so through depository receipts.

Of course, before doing so, evaluate the features and the pros and cons discussed in this article, so that you can make a beneficial decision for your investments.

Happy learning!!

I got an accurate info about GDR and ADR.

Hello Sneha,

Thank you for your comment.

You can read other basic finance blogs.

Happy Reading!!

Wow this was so precise. Just what I needed.

Thank you.

this was explained so well.. thank you!

Hi,

We really appreciated that you liked our blog.

Keep Reading!