English: Click here to read this article in English.

Hindi: आप इस लेख को हिंदी में भी पढ़ सकते है|

বড় / সফল বিনিয়োগকারীরা কোনো সমস্যা কে সাধারণ বিনিয়োগকারীদের তুলনায় অন্যভাবে বিশ্লেষণ করে থাকে | এই বিনিয়োগকারীরা বিশেষ প্রিমিয়াম,এক্সক্লুসিভ কোনো ভাল তথ্য অ্যাক্সেস করে সফল হয় না, তারা অন্যদের চেয়ে তথ্য আলাদাভাবে একই তথ্য ব্যবহার করে থাকে |

- মাইকেল জে মবাউসিন, লেগ ম্যাসন ক্যাপিটাল ম্যানেজমেন্টের প্রধান বিনিয়োগ কৌশলবিদ

শেয়ার ট্রেডিং (বা অন্যান্য ব্যবসা – বাণিজ্য / বাজার ) অনেকের কাছে একটি আগ্রহের বিষয়। আমরা এমন গল্প শুনি যেখানে লক্ষ লক্ষ মানুষ শেয়ার বাজার থেকে উপার্জন করে থাকে । আবার সাথে এই রকম সব উদাহরণ রয়েছে যেখানে লোকেরা সমস্ত স্থাবর অস্থাবর সকল কিছু হারিয়ে ফেলেছে।

শেয়ারবাজারে অর্থোপার্জন কেবল আকস্মিকতার সাথে ধারাবাহিক ভাবে হয় না ,এটি একটি শিক্ষণীয় বিষয় – আমরা আসলেই এটি শিখতে পারি। আসুন কয়েকটি বিধি বোঝার চেষ্টা করি যা আমাদের ট্রেডিংয়ে লাভে থাকতে সহায়তা করবে।

নিয়ম / বিধি ১ : সর্বদা আপনার ট্রেডিং পরিকল্পনা প্রস্তুত রাখুন:

প্রকৃতপক্ষে , ট্রেডিং পরিকল্পনা ছাড়া ট্রেড করার কোনও প্রশ্নই আসতে পারে না।

ট্রেডিং প্ল্যান হ’ল এমন একটি রোডম্যাপ যা আপনি কোনও ট্রেডিং কৌশল বা একাধিক ট্রেডিং কৌশল একসাথে বাস্তবায়নের জন্য অনুসরণ করেন।

একটি প্রকৃত ট্রেডিং পরিকল্পনার জন্য যেসকল বিষয় মেনে চলতে হবে তা হলো : –

ট্রেন্ড এবং প্রাইস অ্যাকসনের ভিত্তিতে সর্বদা টার্গেট নির্ণয় করার সাথে ম্যাক্সিমাম কতটা লস গ্রহণ করতে পারবেন সেটাকেও নির্ধারণ করা অত্যন্ত জরুরি | একটি কঠোর নিয়ম বানাতে হবে যা নির্দিষ্ট ট্রেডিংয়ের সময়ে আবেগপ্রবণীয় না হয়ে হয়ে আপনি যে কোনও নির্দিষ্ট পরিস্থিতিতে সেই নিয়ম অনুসরণ করবেন | এই বিষয়টি অত্যন্ত গুরুত্বপূর্ণ।

নিয়ম / বিধি ২ :ট্রেডিংকে ব্যবসায়ের মতো দৃষ্টিভঙ্গিতে দেখে সর্বাধির সম্ভাবনা বৃদ্দির দিকে মনোনিবেশ করুন :

ট্রেডিংকে ব্যবসায়ের দৃষ্টিতে দেখতে হবে । একটি ব্যবসার যেমন আয় এবং ব্যয় রয়েছে , তেমনিভাবে, ট্রেডিংয়ের আয় হ’ল লাভ এবং ব্যয় হ’ল ক্ষতি এই ভাবে দেখতে শিখতে হবে |

সুতরাং, এটি উল্লেখ করার মতো নয় যে আমাদের অবশ্যই আমাদের লাভগুলি সর্বাধিক করতে হবে এবং আমাদের লোকসানগুলি হ্রাস করতে হবে । যদি আপনি দেখতে পান যে এটি কিছুটা দীর্ঘ সময়ের জন্য ঘটছে না, তাহলে আপনি যে পন্থা অনুসরণ করে ট্রেডিং করছেন সেই পদ্ধতিটাকে বিশ্লেষণ / পরিবর্তন করার প্রয়োজন রয়েছে ।

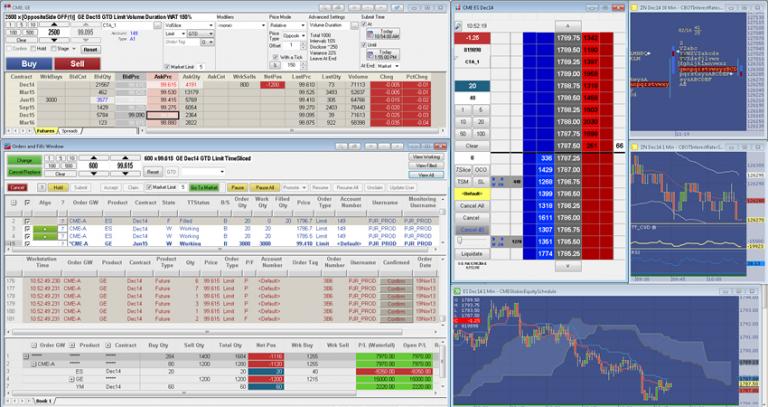

নিয়ম / বিধি ৩: আধুনিক প্রযুক্তির সম্পূর্ণ সুবিধা নিতে হবে :

ট্রেডিংয়ের এবং একটি কাজ যেখানে আপনাকে সর্বদা আপডেট থাকতে হবে দামের প্রতিটা ওঠা – নামা ইত্যাদি বিয়ষয়ে সাথে টেকনিকাল চার্ট – টেবিল আপডেটেড নিউস প্রভিতির যোগান থাকতে হবে হাতের মুঠোয় যা আপনাকে মার্কেটের প্রবণতাটি / ট্রেন্ড সনাক্ত করতে সাহায্য করবে । ভালো করে বিচার করে দেখুন আশাকরি , আপনি এমন কোনও পরিস্থিতির সামনে পড়তে চাইবেন না যেখানে আপনার ব্যবসায়ের সরঞ্জামগুলি কিছুটা পিছিয়ে থাকার কারণে আপনার প্রয়োজনীয় ট্রেডিং অর্ডার সম্পূর্ণ হতে পারবে না – স্লো – এবং পুরানো হয়ে পড়ার কারণে । সুতরাং, ট্রেডিংয়ের জন্য লেটেস্ট আপডেটেড টেকনোলজির ব্যবহার করা খুব প্রয়োজনীয় |

ছবির সৌজন্যে : www.rcgdirect.com

নিয়ম / বিধি ৪ : রক্ষণশীল বিনিয়োগের কৌশল অনুসরণ করুন:

রক্ষণশীল ট্রেডিং কৌশলটি ব্যবসায়ের ডাউনসাইডটিকে রক্ষা করবে । আপনার ব্যবসায়ের কৌশলটি এমনভাবে পরিকল্পনা করুন যাতে সীমাহীন ক্ষতির কোনও সুযোগ নেই। ট্রেডিংয়ে লাভ লোকসান দুই থাকবে তাই মাঝে মাঝে লোকসান নিতে হবে এবং সেটার কারণ বিশ্লেযণ করে নেওয়া উচিত । আপনার লসের হিসাব বিশ্লেষণ করা উচিত এবং অবশ্যই ট্রেডিং কৌশলে এই কারণটিকে প্রাধান্য দিনে পদ্ধক্ষেপ নেওয়া উচিত |

নিয়ম / বিধি ৫ : একজন শিক্ষার্থীর মতো বাজার থেকে শিখতে মনোনিবেশ করুন:

ট্রেডিং করতে গিয়ে আপনি জয়ী হন বা পরাজিত হন না কেন, সর্বদা আপনার ট্রেডিং থেকে কিছু শিখতে চেষ্টা করুন । লক্ষ্য করুন, আপনার ট্রেডিংয়ের কৌশল অনুযায়ী সকল কিছু সঠিক ভাবে কাজ করছে কিনা | যদি তার বৈপরীত্য দেখা যায় তা হলে কী ভুল হয়েছিল সেটা খোঁজার চেষ্টা করুন ? এবং আপনার ভুলগুলি নোট করুন যাতে আপনি সেগুলি পুনরাবৃত্তি না ঘটে । ভুলের “কারণ” এবং “প্রভাব” বের করার চেষ্টা করুন। বিভিন্ন উৎস থেকে শেখার চেষ্টা করুন। মনে রাখবেন “মার্কেট সবাইকে নম্র করে”। বাজের সবার ওপরে , তার ওপরে কেউ নয় |

নিয়ম / বিধি ৬ : আপনি চিবানোর চেয়ে বেশি কামড় দেবেন না:

আমরা সবাই জানি যে ট্রেডিং ঝুঁকিপূর্ণ ব্যবসা তাই এইখানে মূলধনের ক্ষতি/ হ্রাস হওয়ার সম্ভাবনা প্রবল । এখানে “২ শতাংশ মূলধনের নিয়ম” রয়েছে যা অনেকেই অনুসরণ করে থাকেন যা অতিরিক্ত ঝুঁকি গ্রহণকে হ্রাস করার এক উপায়। আপনি যদি লিভারেজ ব্যবহার করেন তবে আপনার এটি সম্পর্কে খুব নিশ্চিত হওয়া উচিত। লক্ষ্য করুন যে আপনার বেট সাইজটি আপনার ট্রেডিং কৌশল অনুসারে নেওয়া হয়েছে নাকি ‘মুহূর্তে’ সিদ্ধান্তের ওপর নির্ভর করে নেওয়া| এই সকল জিনিস পুংখানু পুঙ্খ নজর ও মেনে চলতে হবে ।

নিয়ম / বিধি ৭ : একটি যুক্তিসঙ্গত ট্রেডিং পদ্ধতি তৈরি করুন যা প্রচেষ্টার পক্ষে উপযুক্ত:

ট্রেডিং হলো নিয়ম, পদ্ধতি, শৃঙ্খলা, ধৈর্য এবং আবেগশূন্য বিষয় । উল্লিখিত সকল কিছুই আপনাকে ধর্মগ্রন্থের বাণীর মতো অনুসরণ করা উচিত । আপনি আপনার পূর্বনির্ধারিত বিধি এবং কৌশল থেকে বিচ্যুত হবেন না। কিছু ক্ষেত্রে কয়েকবার লঙ্ঘন করে যেতে পারেন তবে, দীর্ঘমেয়াদে, আপনি যদি নিজের ট্রেডিং কৌশল অবলম্বন না করেন তবে আপনার মূলশন ক্ষতিগ্রস্থ হতে বাধ্য । সুতরাং, ট্রেডিং কৌশল নিয়ে কাজ করা কাজের দিক থেকে সর্বাধিক গুরুত্বপূর্ণ বিষয় । আপনি যে সমস্ত প্রচেষ্টা রেখেছেন তা সম্পূর্ণরূপে মূল্যবান তাই সকল নিয়ম মেনে চলুন ও সঠিক দিশাতে ট্রেডিংকে এগিয়ে নিয়ে যান |

নিয়ম / বিধি ৮ : স্টপ লস উপেক্ষা করবেন না:

আমরা লাভ করার জন্য ট্রেডিং করি। তবে এমন পরিস্থিতি তৈরি হতেই পারে যখন জিনিসগুলি আপনার ট্রেডিং কৌশলের বিরুদ্ধে যাবে এবং আপনাকে লস বুক করতে হবে যাতে আপনি অন্য দিন লড়াইয়ের জন্য বাঁচতে পারেন। স্টপ লস আপনার মূলধনকে সীমাহীন ক্ষতির থেকে রক্ষা করে । প্রতিটি ট্রেডিংয়ের জন্য স্টপ লস নির্ধারণ করা লাভের অনুমানের হিসাবে প্রয়োজনীয়। সর্বদা মনে রাখবেন, যখন আমরা লাভের দিকে লক্ষ্য রাখি তখন আমাদের অবশ্যই সর্বদা লসের দিকেও নজরে রাখতে হবে এবং তা ম্যানেজ করতে হবে। এটি স্বয়ংক্রিয়ভাবে স্টপ লস দ্বারা সম্পন্ন হবে।

নিয়ম / বিধি ৯ : কখন ট্রেডিং বন্ধ করবেন পরিস্থিতি সনাক্ত করুন:

ট্রেডিং করতে গিয়ে অনেক সময় এমন পরিস্থিতি আসবে যেখানে আমাদের মানব জীবনের আবেগগুলি আমাদের ব্যবসায়ের কৌশল এবং নিয়মগুলি যা আমরা নিজের ট্রেডিংয়ের জন্য সেট করে রেখেছি তা নিয়ন্ত্রণ করতে চাইবে । মনে রাখবেন আপনি বাজার থেকে প্রতিশোধ নেওয়ার আশা করতে পারবেন না।মার্কেটের প্রতি , কোনো নির্দিষ্ট শতকের প্রতি প্রতিশোধ পরায়ণ এবং আবেগাপ্লুত হয়ে পড়বেন না |

উদাহরণস্বরূপ: যদি আপনি ইনফোসিসের শেয়ারের ট্রাডিং করতে গিয়ে লোকসান করে থাকেন তবে ওই ইনফোসিসের স্টকে ট্রেডিং করে আপনার লোকসানগুলি পুনরুদ্ধার করতে হবে এমন কোনও মানসিকতায় আসবেন না। হতে পারে এই সময় স্টকটিতে ট্রেডিংয়ের সঠিক সময় নয় , তাই এটি থেকে বেরিয়ে আসুন।

যদি এমন পরিস্থিতি দেখা দেয় যেখানে আপনার ট্রেডিং বন্ধ করা দরকার সেই ক্ষেত্রে পরিস্থিতিকে সম্মান করুন এবং স্টপ লস ব্যবহারের মাধ্যমে ট্রেডিংটিকে ক্লোস করুন। মনে রাখবেন মানুষ ইমোশনাল প্রাণী হলেও বাজার কারও অহঙ্কার বা প্রত্যাশা সম্পর্কে চিন্তা করে না।

নিয়ম / বিধি ১০ : ট্রেড করার সময় সম্পূর্ণ মনোনিবেশ করুন:

“বল থেকে চোখ সরাবেন না “

যতক্ষণ আপনি কোনও ট্রেডিংয়ে পজিসন হোল্ড করছেন ততক্ষণ মনোযোগ কেন্দ্রীভূত রাখা অত্যন্ত জরুরি । আত্মসুখ আপনাকে মূলধনের রক্ষক্ষরণ / লোকসান ডেকে আনতে পারে । মার্কেটে অর্থউপার্জন বেশ কঠিন কাজ তাই ক্যাসুয়াল হয়ে নিশ্চই আপনি কখনো অর্থহানি করতে চাইবেন না|

ফোকাস থাকা / মনোনিবেশ করা আপনাকে আগামী ট্রেড এবং ট্রেডিং সম্ভাবনাকে সনাক্ত করতে সাহায্য করবে |

পাদ-পংক্তি:

ট্রেডিং একটি শক্ত কাজ – এটির অস্বীকার করার উপায় নাই । তবে সবচেয়ে গুরুত্বপূর্ণ বিষয় হলো ট্রেডিং হলো এমন এক বিষয় যা প্রশিক্ষণ এবং অনুশীলনের মাধ্যমে শেখা যায়।

মার্কেট / ইনডেক্সের মভকে অতিক্রম করে বেশি রিটার্ন উপার্জন সম্ভব কিন্তু তার জন্য সঠিক নয়জন – বিধ- – শৃঙ্খলা – ট্রেডিং কৌশল মেনে চলতে হবে |